Kidney Capital: Who, When & What Gets Funded In Kidney Care, Part 1

Data from 14 of the most active investors from idea to IPO

Welcome to Kidney Capital, where great ideas, research, products and teams get funded to build the future of kidney care across the globe.

We begin our exploration of the expanding Kidneyverse with a closer look at why, how, and when these ideas get funded— and who is backing them.

What's in this table:

Who & When: The left-most columns in this table contain 14 of the most active investors in kidney care across the company lifecycle. This group broadly represents four investor types from idea to IPO: (a) accelerators; (b) early stage venture capital; (c) growth equity; and (d) strategic capital.1

What: There are 4 segments (colors) highlighted in this table: Care delivery (yellow), devices (purple), diagnostics (blue), and other (green). For what it’s worth, I track 9 segments across the Kidneyverse.2

Why: Investments happen because founders and investors share a unique point of view about what the future looks like. It’s as much about timing (why now?) as it is about fit (why you?). First, I’ve separated investments (solid border lines) from mergers & acquisitions (dotted lines). Second, I’ve included a crown (“👑”) for companies with an exit, either through M&A or IPO.3

Signals

CVS wants to deliver care… everywhere

Baxter is about to make its biggest bet ever

YC is picking up the pace on its bio x health bets

A Tale of Two LDOs: comparing dialysis investments

Public investments work: KidneyX and America’s Seed Fund

Why Oak HC/FT is fueling the future of care delivery

Death Valley: what happens to accelerate-ed MedTech startups?

IPO Cometh: why kidney care will be part of the 2024 IPO window

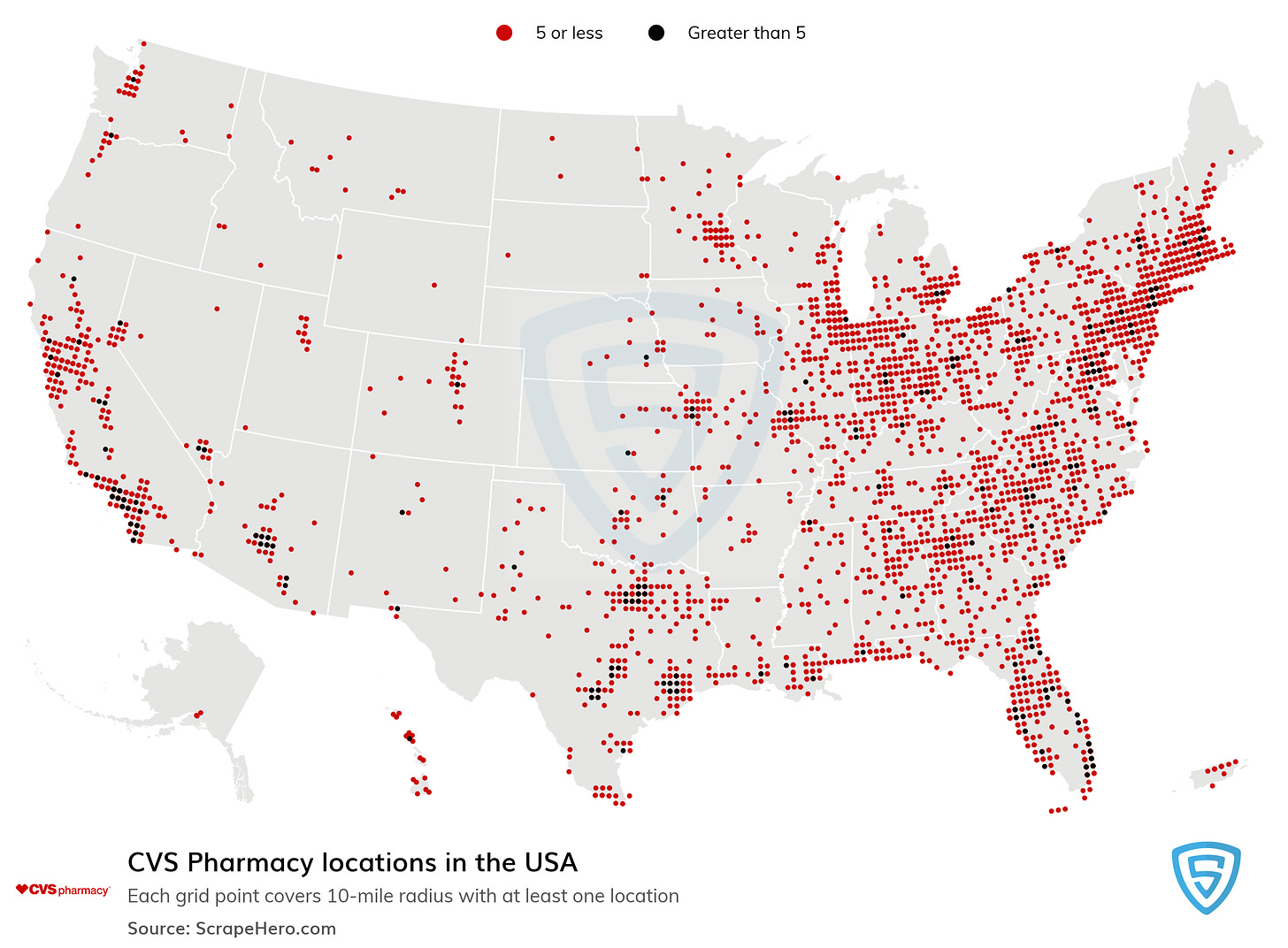

CVS wants to deliver care to the 85% of Americans who live within 5 miles of a CVS pharmacy

Most of you will be familiar with the Oak Street ($10.6 billion) and Signify Health ($8 billion) deals that closed last year. These two deals, along with the others below, paint a compelling picture of how the sixth largest company in the world will continue to make its way into direct care delivery by adding products & services to its footprint of over 9,000 stores and pharmacies.

Beyond direct acquisitions, CVS launched their $100 million corporate venture fund in 2021 and have made a series of bets across the tech-enabled care landscape.

Notable deals

Strive Health’s $166 million Series C, which specializes in home and virtual care for patients with chronic kidney disease and kidney failure (2023).

Monogram Health’s $375 million growth round, which provides in-home and virtual care for polychronic conditions like chronic kidney disease (2023).

Carbon Health $100 million Series D, and announces new CVS partnership to pilot Carbon’s primary and urgent care clinic model in CVS stores (2023).

Waymark’s $42 million in new funding, to scale its tech-enabled, community-based care for primary care providers and people enrolled in Medicaid (2023).

Baxter’s biggest bet to date

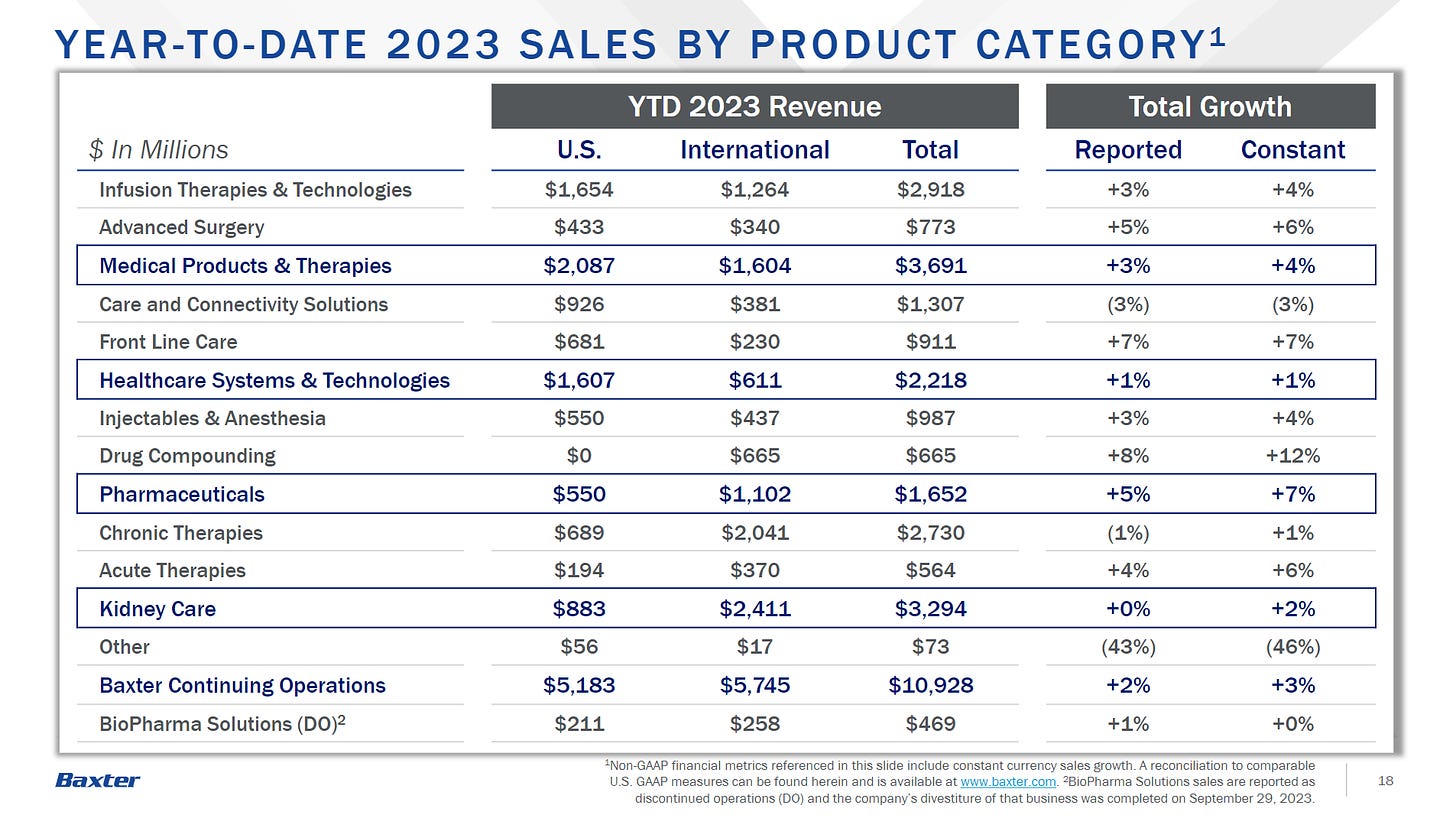

Here’s the most recent growth story for Baxter based on their 3Q earnings report from November. The company is seeing solid demand for its Pharma, Medical Products & Therapies businesses, while still investing in growth and launching a deep pipeline of products from injectables to ophthalmology.

Baxter plans to spin off its Kidney Care business in the first half of this year. The new public company, called Vantive, will have a 70-year history of renal therapies — with devices in the home, clinic and ICU and currently reaching more than 1 million patients in over 70 countries.

Coming soon: I’ll be sharing a Vantive preview in the coming weeks.But enough about today, let’s talk about a few of Baxter’s ~20 acquisitions made since 1998 across devices and life sciences.

Notable deals

The $10.5 billion Hillrom deal in 2021 was meant to expand their geographic footprint and add digital health & connectivity to the portfolio, but it didn’t exactly go as planned.

Also in 2021, Baxter acquired toSense, the company that developed sensors and software for applications in non-invasive patient monitoring, best known for its CoVa Monitoring System for at-home patients with chronic illnesses.

Baxter acquired Gambro for $3.9 billion in 2013 for its dialysis products and therapies, as well as its footprint in Europe.

Baxter acquired Synovis in 2012 to expand its regenerative medicine and advanced surgical technologies portfolio.

Also in 2012, Baxter led a $38 million funding round in Naurex, a company that was developing treatments for depression and pain that was ultimately acquired by Allergan for $560 million in 2015.

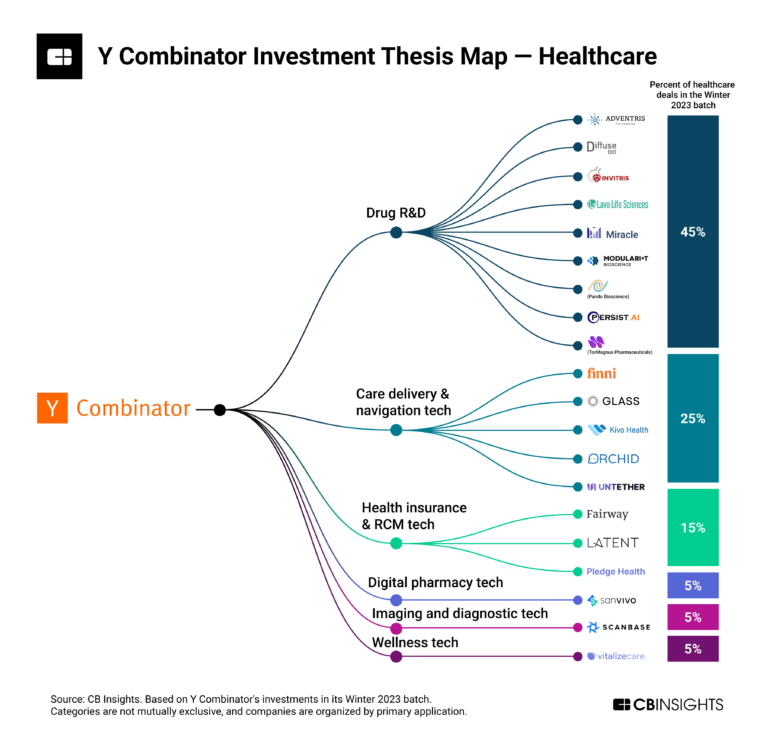

Y Combinator’s healthcare and bio bets are accelerating under Subhi Sarna’s leadership

In 2021, Y Combinator named Subhi Sarna its first-ever partner for healthcare and biotech after selling her startup, nVision, to Boston Scientific for $275 million in 2018. If you are unfamiliar with YC’s accelerator model, impact or founding story, it’s worth taking some time to appreciate.

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)