Risk On: Value-Based Kidney Care Is Here

CMS just announced 123 KCC participants and 9K+ providers for 2024

Today I’m venturing beyond my comfort zone to dip my fingers and toes into the very uncharted waters of value-based care. Until now, my two cents have been limited to collecting and curating simple visuals to keep track of key players in and around kidney care. That remains true, and this post has a whole lot more of it.

But two emerging trends have changed my thinking a bit.

First, my most recent VBC piece — this summary table — led to dozens of follow-on conversations and requests for more info. After each call I look down at my notes to find a list of a dozen or more unanswered questions. That’s why I put the VBC database together in the first place, as a visual reference during these types of calls (it’s in the data room).

Second, with the launch of Kidneyverse Careers I realized just how many people want to be a part of the unstoppable force known as value-based kidney care. Whether or not the kidney failure treatment options prove to be the immovable objects from lore remains to be seen. My hope is that this article becomes a tool for those seeking and preparing for their next missions across the value-based space.

Case in point, a few weeks ago I asked people what the greatest headwind for value-based care will be in 2024. Talent was number one (33%), followed by capital (28%) and scale (24%).

If this post helps even one of you move closer to your personal or professional career goals in this space, that’s a win for all of us. Let’s get to it, starting with why now?

Background

In 2021 the Biden administration set the goal of bringing all 34 million beneficiaries in traditional Medicare into value-based arrangements by 2030.

In fact, driving accountable care was one of five strategic objectives laid out in CMMI’s vision-defining white paper that year. The Affordable Care Act (ACA) authorized CMMI to launch 54 value-based programs over the past ten years, which now include more than 18 million patients and 200,000 providers.1

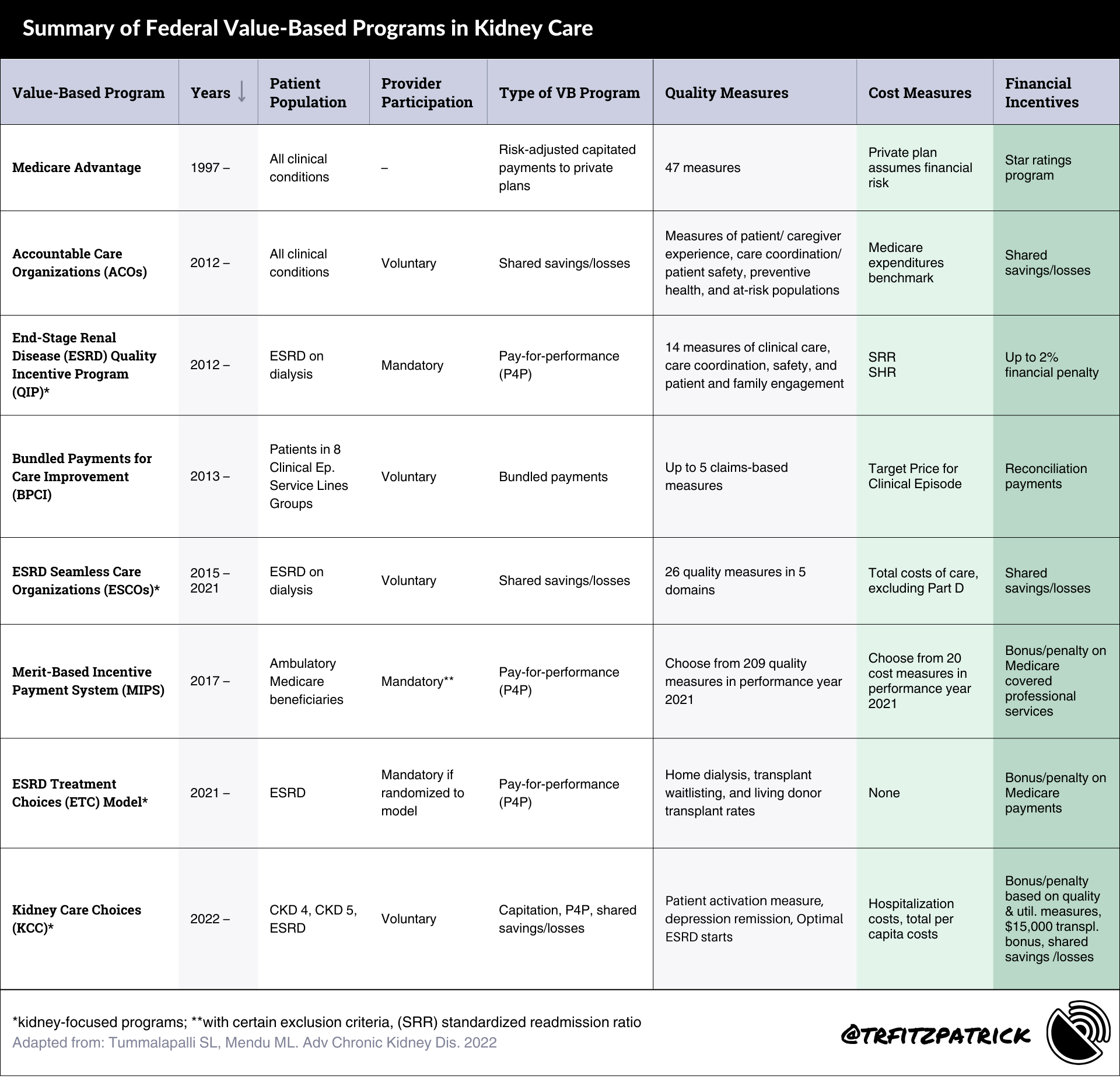

If we zoom-in on those programs with kidney-related aims, there are 7 programs since 2012 that range from the all-encompassing Medicare Advantage (MA) to the more recent Kidney Care Choices (KCC) model.

We’ll get into KCC shortly, but for now here’s a table I adapted from a great summary piece that compares the different models and their key components, in descending order by launch date.2

So, what’s new?

Value-based care for kidney disease is increasingly relevant in light of the Advancing American Kidney Health (AAKH) initiative, which introduced new value-based payment models: the mandatory ESRD Treatment Choices (ETC) Model in 2021 and voluntary Kidney Care Choices (KCC) Model in 2022 (see table).

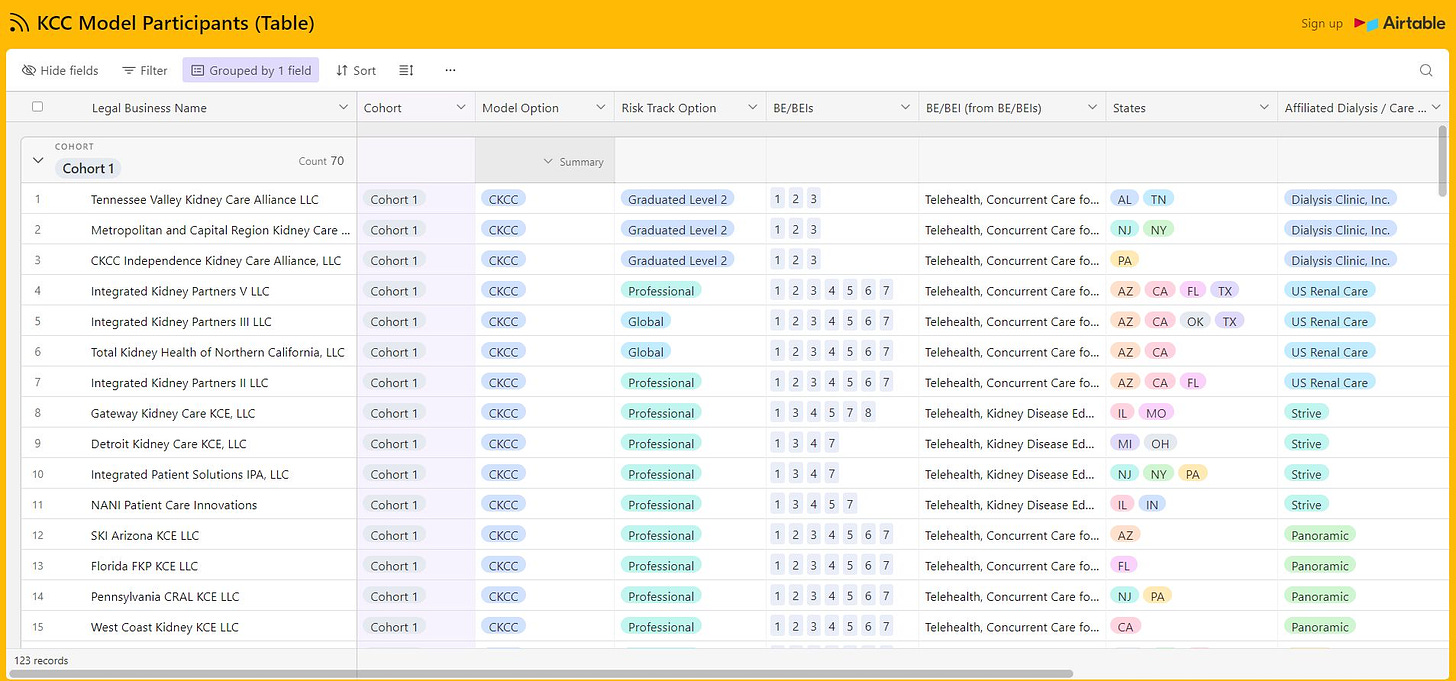

Last month, CMS shared an update on its KCC Model participants for 2024, which includes 123 participants, over 9,200 providers, and more than 280,000 beneficiaries.3

The model itself can be a bit daunting, but it doesn’t have to be. I put together the graphic below to help you understand the basics of the model, its overall aims, and what the various risk options and benefits entail.

By the numbers

In 2024 there are about 13.7 million people with Traditional Medicare aligned to an ACO.4

ACOs are now serving nearly half of the people with Traditional Medicare (up +3% year over year).

The KCC model includes 100 Kidney Contracting Entities (KCEs) and 23 CMS Kidney Care First (KCF) Practices

The KCC Model has more than 9,227 participating health care providers and organizations (up +10% year over year)

Discussion

This is the first of what is sure to be several posts on this topic over the next many months, especially as we continue to see growth (and eventual consolidation?) across the space. We’re in it for the long haul.

In my conversations with many of you, a few of those questions I mentioned earlier keep bubbling to the surface. In closing, I thought I’d share a few of them here to open a thread where you can share your POV, insights and questions.

As always, I welcome any and all feedback on this topic as I’m getting up to speed and building my situational awareness.

Open questions

On the market: What is the total “opportunity” size in terms of people with kidney disease who might be managed in these models?

On upstream care: How will earlier diagnoses impact these models? What if we could increase diagnosis rates to 15%? 20%? 50%?!

On outcomes: How do value-based care programs impact the total cost of care (TCOC) for patients on dialysis? Transplant? Post-transplant?

On utilization: Do value-based care programs improve home dialysis utilization rates? Do they improve home capacity across multiple stages and care settings?

Keep Exploring

What is VBC and why does it matter to digital health startups? (Halle Tecco)

Analyzing the Expanded Landscape of Value-Based Entities (HMA)

Thanks for tuning in this week. Subscribe to stay up on the latest signals in kidney care and technology — and please share this post with 1-2 people in your corner of the Kidneyverse if you found it helpful!

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)