Across the Kidneyverse: April 19, 2024

Xenotransplant, biopharma M&A, KCC at risk & community voices

By Tim Fitzpatrick

Welcome back to Across the Kidneyverse, our monthly recap where we look at top headlines, market movers, research and commentary from the past four weeks. This month we’re marking major milestones in transplant, biopharma M&A, frictions from CKCC payment cuts, lessons from RPA, and a number of startup financings you should have on your radars.

Have tips or feedback? Hit reply or join the conversation here.

Reading time: 25 minutes

Reminders

Kidneyverse Careers is the only place dedicated to bringing top talent and companies together across kidney care. I’m going to start sharing a few open roles per month here in the newsletter. Reach out if you want to highlight your company’s roles.📣

The Signals Inbox is open to anyone who wants to share news, tips, and updates that belong in this monthly recap. It’s anonymous, so let me know what you’re seeing and hearing out there!

Contents

Headlines

Here’s what caught my eye across the Kidneyverse this month, organized by topic.

Discovery & Innovation

Covering the latest in research, development, and breakthroughs.

Doctors have transplanted a genetically modified pig kidney into a living human patient for the first time ever. Scientists have been developing genetically engineered pigs as a way to address the critical lack of human organs available for transplant surgeries. Richard Slayman is the 62-year-old patient who was discharged from Mass General two weeks ago. His doctor said he would not have been able to survive the five to six year wait period for a kidney. Richard shared his own thoughts on his role in this exciting milestone:

"I saw it not only as a way to help me, but a way to provide hope for the thousands of people who need a transplant to survive.”

Mark Lim recently shared an update on KidneyCure, ASN Foundation’s program that strengthens a pipeline of kidney researchers from graduate school to early-career faculty. KidneyCure is a long-term play to support the passion and dedication of the person advancing kidney research. The team received over 100 applications across their three programs in this year's cycle and on March 14-15, KidneyCure's Grants Review Committee convened to discuss their reviews. Good luck, future fellows!

A recent paper by Drs. Ben Hippen, George Hart, and Frank Maddux proposes a future transplant-inclusive VBC (TIVBC) model designed to supplement current models focusing on patients with advanced chronic kidney disease (CKD) and end-stage kidney disease (ESKD). The proposed TIVBC model is structured as an episode-of-care model with risk-based reimbursement for referral / evaluation / waitlisting (REW); primary hospitalization to 180 days post-transplant; and long-term graft survival.

Paul Gordon shared a thought-provoking study on the correlation between poverty and the prevalence of CKD published online by CDC. The authors point out living in high-poverty neighborhoods has been identified as a contributing factor to the development and progression of chronic kidney disease. Further, understanding the distribution of CKD at the county level in relation to poverty level is important: this knowledge can guide population-level interventions for CKD prevention and management.

Market Insight

Trends, funding updates, and industry developments.

In a major, rare M&A move for Vertex Pharmaceuticals, they have agreed to acquire Alpine Immune Sciences for $4.9 billion, the largest deal in its history, which will deepen its pipeline in kidney disease— and which already has two clinical-stage candidates. Fun fact: Vertex CEO Reshma Kewalramani, MD FASN was a nephrologist at Mass General before joining the industry!

San Diego-based Biolinq raised $58 million for its wearable device that aims to deliver easier glucose-monitoring— it uses microneedles to measure blood sugar and doesn’t require a separate device to deliver its results.

Interwell Health shared that nephrology practices in the southeast that participated in Interwell Health’s government program saw a 69% increase in dialysis optimal start rates from 2021 to 2023.

Mozarc Medical turned one this month! 🎂 The joint venture between Medtronic and DaVita launched as an independent kidney health technology company on April 1, 2023. Starting Q4 of FY24 we expect to see Medtronic report revenues at the segment and division levels, which includes Mozarc’s manufacturing & servicing agreements.

IKONA and Lifeliqe announced a partnership to bring VR dialysis training content to kidney care organizations in the US. By combining IKONA’s expertise in patient education and kidney care with Lifeliqe’s advanced workforce training and simulation capabilities, including dialysis Patient Care Technician (PCT) training, the partnership is poised to address a broad range of top priorities across healthcare settings, from doctor’s offices and dialysis centers into patients’ homes.

Three international nephrology societies have issued a statement asking for the World Health Organization (WHO) to add chronic kidney disease (CKD) to its list of noncommunicable disease (NCD) public health priorities. In their statement the ISN, ERN, and ASN point out that global mortality from all kidney diseases likely ranges between 5 million and 11 million per year, and kidney dysfunction is currently the seventh leading risk factor for death.

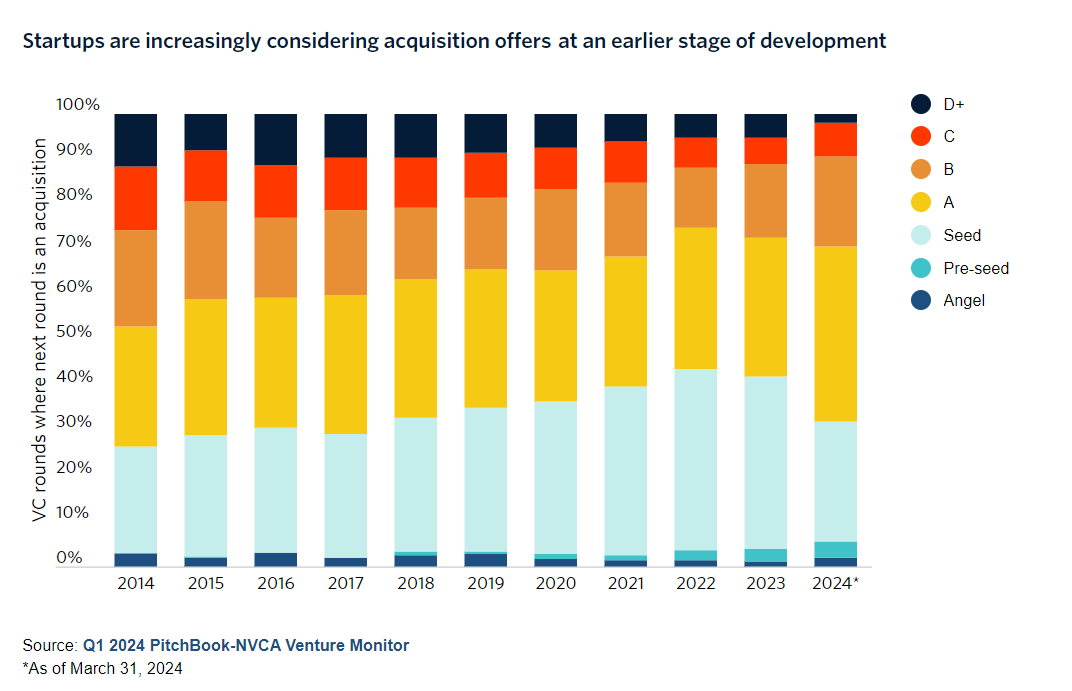

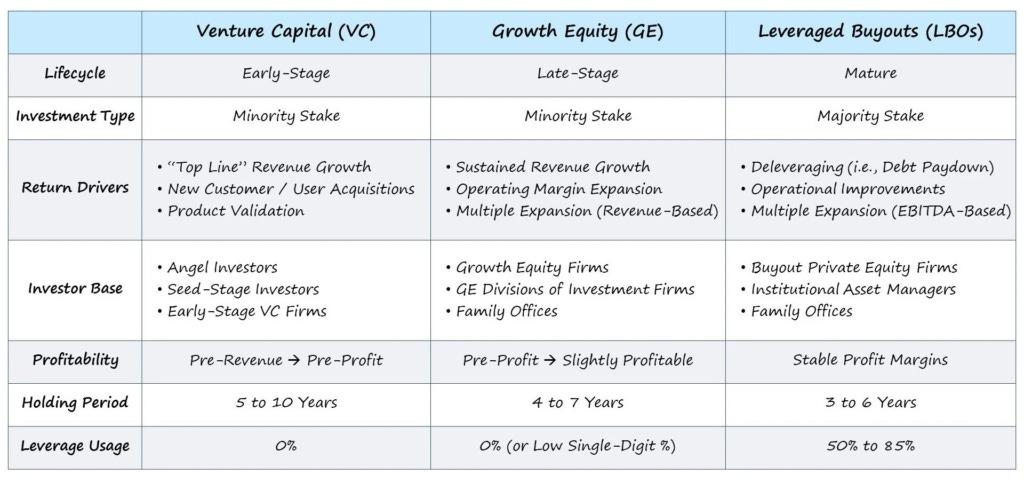

Data from Pitchbook shows that over 55,000 VC-backed companies are operating in the US right now. Now that’s That’s a few too many relative to the number of venture firms and funding available to support those companies — which partly explains why around 3,200 startups failed in 2023. Because of this, founders are considering acquisitions earlier in their lifecycle. 90% of the acquisitions of US VC-backed companies in Q1 of this year were made either prior to or just after the company’s Series B closed. For more healthcare- and kidney-specific data, check out SVB’s report from January.

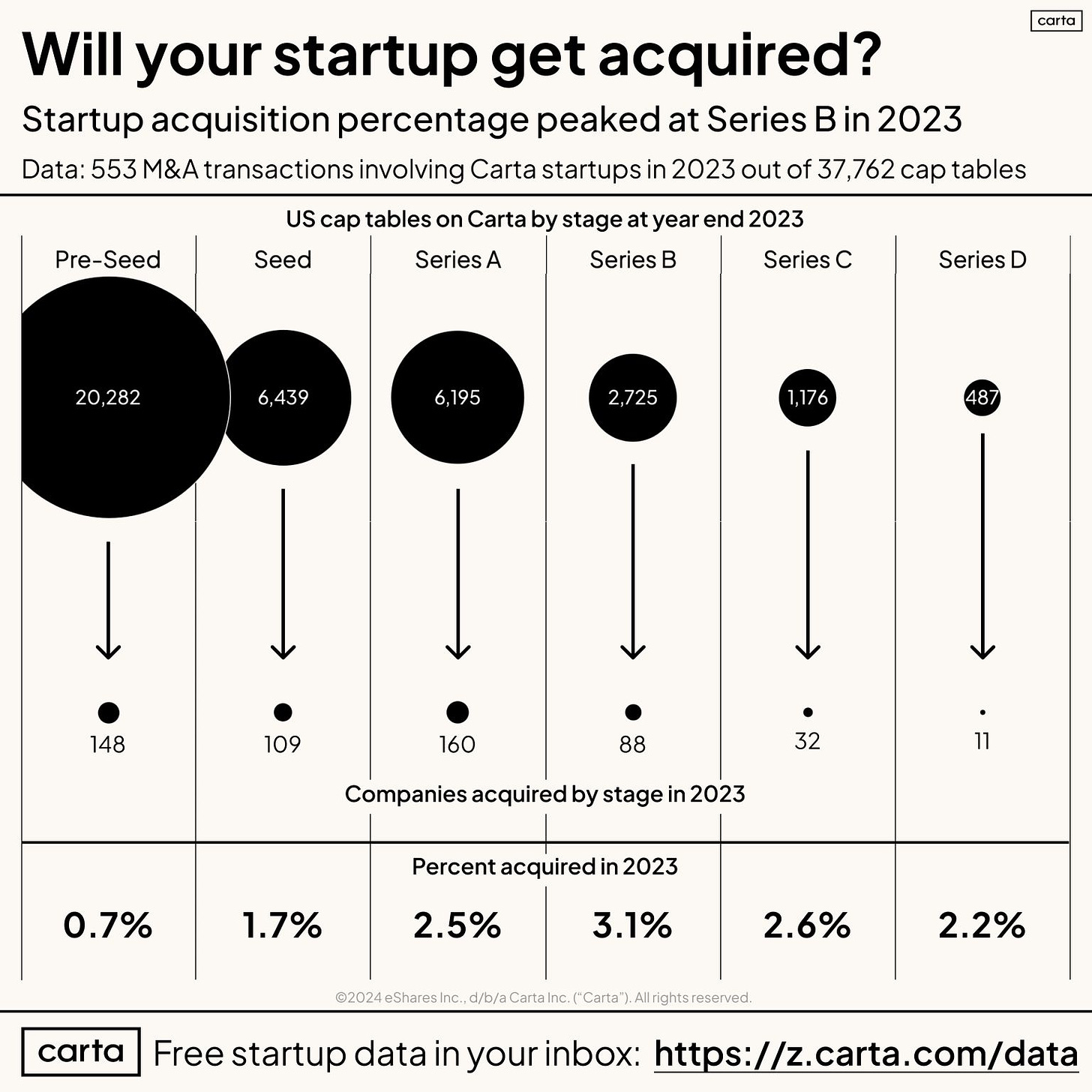

Okay, now let’s zoom in on last year’s data. Here’s what we learned from 553 M&A transactions involving Carta startups out of more than 37,000 cap tables managed on their platform. The bottom-line? In 2023, the startup acquisition percentage peaked at Series B (3.1%). This begs the question, what happens to a category of companies with $100M+ raised, beyond Series B, and all vying for similar cohorts and customers?

Policy & Regulation

Updates on policies, regulations, and government initiatives.

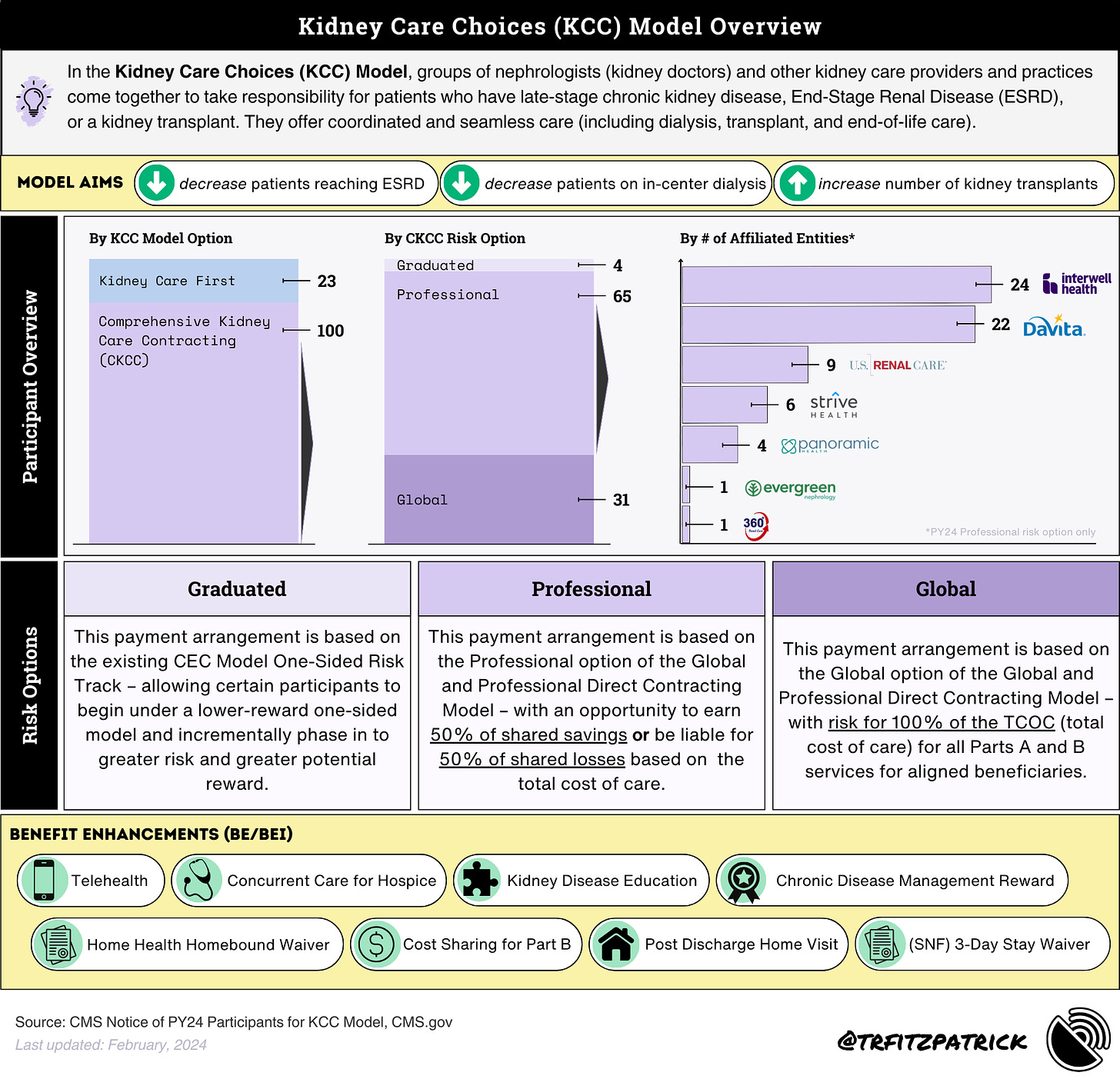

Nephrologists may leave the Kidney Care Choices model if CMS issues payment cuts. RPA president Dr. Keith Bellovich said “these [RTA] assumptions, using data from years when COVID skewed kidney care utilization, were completely unexpected and two to three times larger than anticipated. The reenrollment deadline for the program is coming up fast— April 30, 2024.

On that note, CMMI Director Liz Fowler joined the RPA Meeting in Baltimore last weekend where she shared that the transition to value-based kidney care has been slower than initially thought. She and her team are aware of benchmark setting issues (frankly, benchmarks have been an issue and RTAs are not ideal, but necessary per regulatory requirements. Heavy transition to Medicare Advantage may have muddled the market. (H/t Charlotte Dixon for the on-the-ground reporting and photos).

“Maybe [VBC] is an ultra marathon— not just a marathon, and not a sprint.”

Community Voices

Commentary, opinions, and events across the kidney care community.

The next Kidney Health Initiative (KHI) Monthly Mixer will take place on April 22. This mixer aims to gather KHI members to discuss the latest advancements and ongoing efforts in the field of APOL1 kidney disease. APOL1 gene variants are known to increase the risk of developing kidney disease in certain populations. (h/t for sharing, Uptal Patel)

During his ACP Internal Medicine Meeting keynote, Dr. Eric Topol said “AI can be used to restore the patient-doctor relationship because the EHR administrative burden has made medicine ‘fast and shallow.’” He also said using AI for ambient documentation can provide “keyboard liberation” and give doctors more opportunities for eye contact and “laying of hands” during the medical encounter, which can also benefit the mental health of the physician.”

A New York Times op-ed titled “Let People Sell Their Kidneys. It Will Save Lives.” made a few waves earlier this month. As its title suggests, author Dylan Walsh makes the case for creating a market for kidneys. This is a sensitive, divisive subject, and has been for decades. A number of national, state, and grassroots efforts seem to be picking up steam as of late, with varying types and degrees of (dis)incentives aimed at reducing barriers to organ donation. What do you think? Join the chat below and let us know.

DaVita’s CMO for home modalities and pediatrics believes that to truly achieve widespread adoption, it is critical that we identify, analyze and develop solutions to overcome the factors driving disparities in home dialysis. Dr. Mihran Naljayan wrote a perspective piece in Healio this week that pointed out trust in their physician was cited as the most important factor in the initial modality decision for patient groups and their care partners.

Blake Madden hosted a virtual event this week on VBC specialty care and key themes in cardiology and kidney care. He was joined by Ben Kuhn (Chief Strategy Officer at Strive Health) and Ian Koons (CEO at Karoo Health). Check out the free registration page here to get the recording.

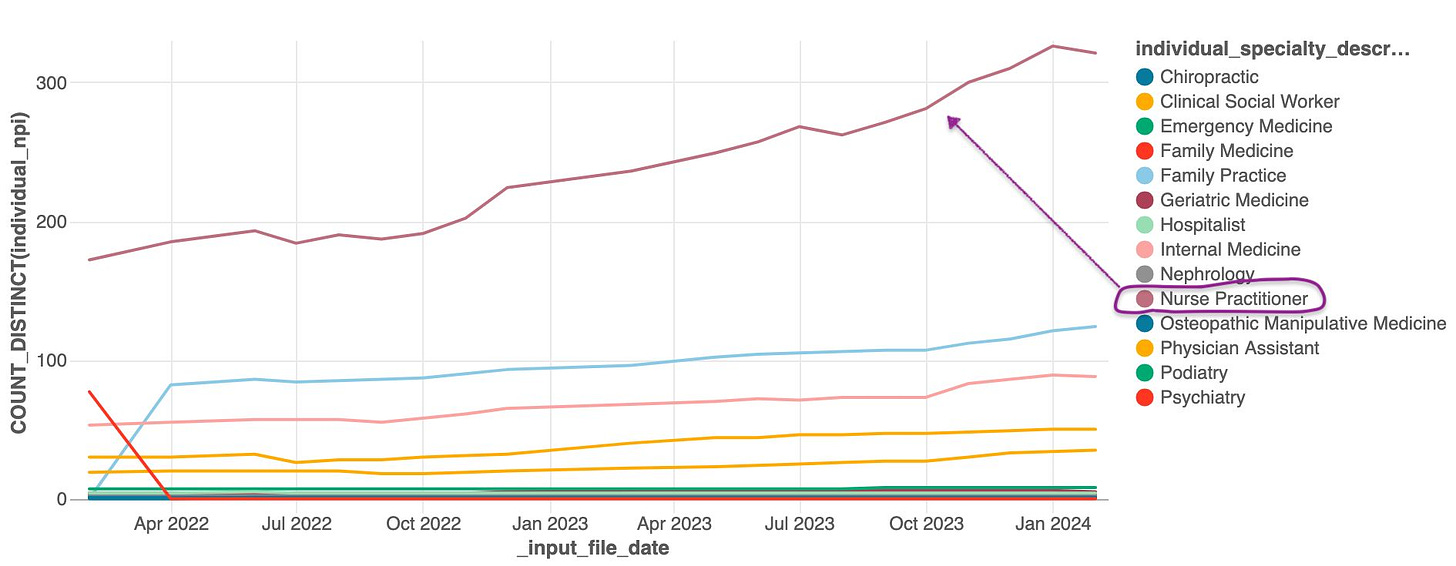

Dr. Yubin Park recently shared a fascinating take on why nurse practitioners (NPs) will play an extremely critical role in Oak Street Health’s future. He says, “The chart below shows the Medicare provider composition trends under an organization name that starts with "Oak Street…” An interesting pattern emerges if I count the number of unique NPIs (National Provider Identifiers) over time. One provider type has a solid upward trend: Nurse Practitioners (NPs).” Note: Recall Oak Street has interesting positioning here with its $10.6 billion acquisition by CVS, joint venture with Interwell, and existing multi-state partnerships with specialty VBC providers in nephrology.

An article in Healio talks about why shared decision-making between nephrologists and patients is key to conservative kidney management. Dr. Bhavika Gandhi from Southwest Kidney Institute in Phoenix shared her thoughts and experiences, saying “If patients are at the point where they have made up their mind about not starting dialysis, I make it clear that this is an option. You can decide not to do anything.”

Travis May wrote another excellent article for founders, this time on starting a company in 2024 while grappling with questions like “how is AI going to change this industry” and “are we in an AI bubble?” The post walks through his 7 principles for betting on the AI boom that every founder, operator, and strategy leader should read. Travis is the CEO of Shaper Capital, Chairman of Arbital Health, and former Founder-CEO of Datavant.

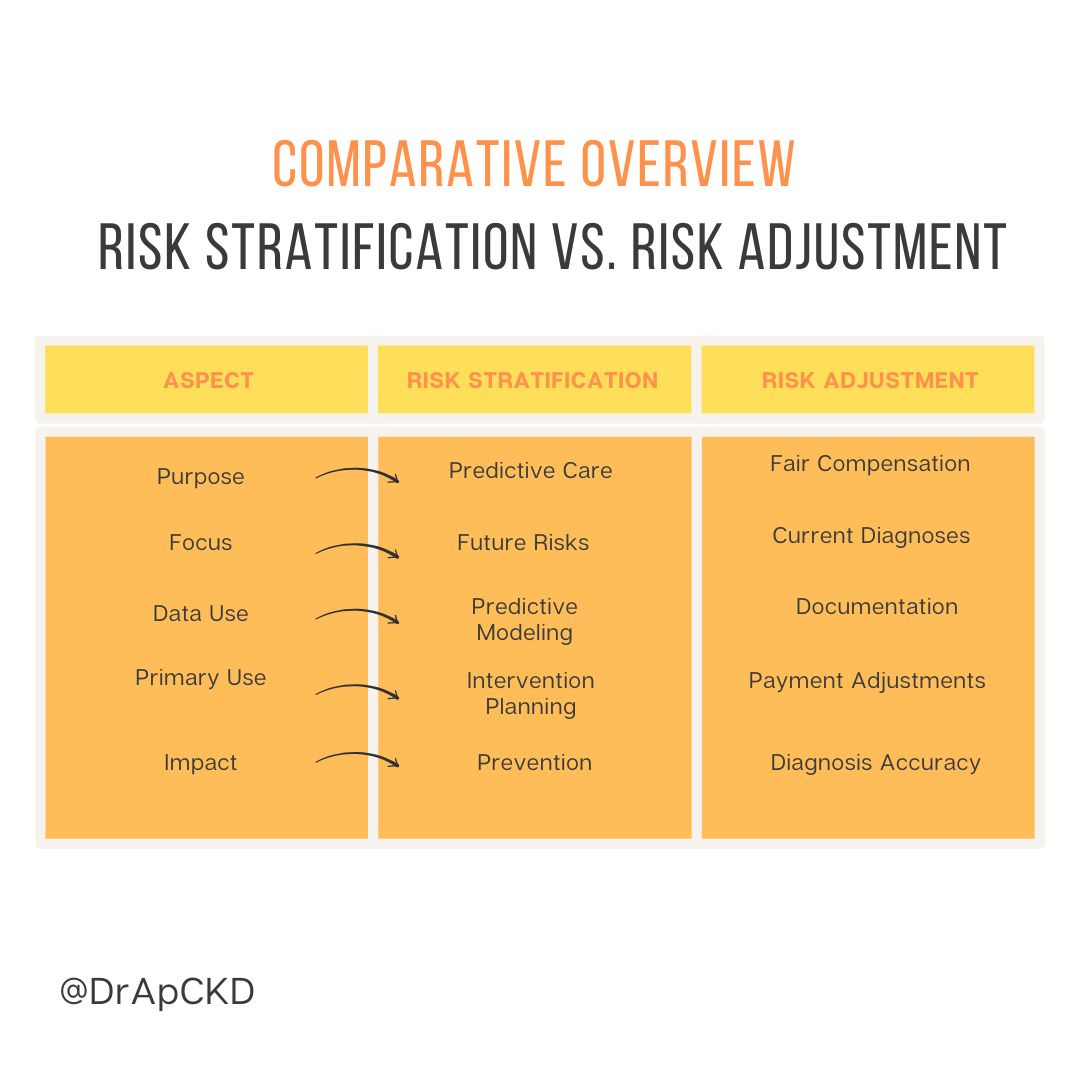

Dr. Amber Paulus shared a helpful visual overview of risk stratification vs. risk adjustment on her LinkedIn page earlier this week. She shared that during his session at ANNA, Dr. Jay Agarwal provided clarity in a way she hadn’t seen before and it led to a great discussion for those in attendance. Luckily for us, Amber shares great visuals of complex topics in kidney health management.

Dr. Dave Chokshi shared a perspective piece from NEJM on why integrating public health and health care matters, and how we can do it. The authors say “protecting health is a team sport— yet the public health and clinical care systems meant to advance this goal have been siloed for too long.

Need a bit of inspiration? Suni Lee became the first Hmong American to compete in the Olympics in Tokyo— you may remember her all-around gold-winning routine. But in early 2023 she was diagnosed with two kidney diseases that took her out of gymnastics and questioned her future. Well the good news is Suni is back thanks to her doctors, health, and mindset— doing what she loves and vying to earn her spot on the 2024 Paris Olympic team. Good luck, Suni!

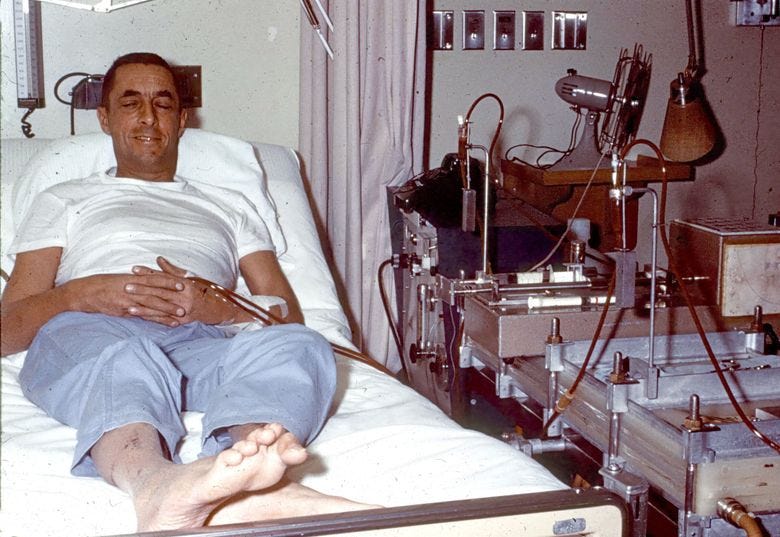

A recent op-ed in Seattle Times talks about Clyde Shields, the world’s first ongoing kidney dialysis patient. Clyde lived for 11 years on dialysis, and served as a research partner as much as a patient in that time. Northwest Kidney Centers was founded 62 years ago — a Dialysis Museum opened last month at their Burien clinic.

A Closer Look

Here’s a closer look at a few headlines from above and why they matter:

1. World’s First Genetically-Edited Pig Kidney Transplant into Living Recipient Performed at Massachusetts General Hospital.

Surgeons from the Mass General Transplant Center conducted the four-hour-long surgery on Saturday, March 16. This marks a major milestone in the quest to provide more readily available organs to patients.

Scientists have been developing genetically engineered pigs as a way to address this gap that measures over 100,000 lives. Several proof-of-concept experiments with such pig organs have been done in recent years; one involved hooking a kidney up to a brain-dead organ donor's body, and another involved performing a double-kidney transplant in a brain-dead patient. In addition, in 2022, a man underwent the first pig-heart transplant but died shortly thereafter.1

Why it matters: The kidney itself came from eGenesis, a biotechnology company that's developing human-compatible engineered organs. The company uses the famous gene-editing system CRISPR to tweak the genes of its pigs. In all, the scientists make 69 edits in the pig DNA. Dr. Leo Riella, Mass General’s transplant program director, says:

“Our hope is to one day make dialysis obsolete.”

2. Vertex Pharmaceuticals announced it will buy Alpine Immune Sciences for $4.9 billion— its largest M&A deal, ever.

Vertex Pharmaceuticals has agreed to buy Alpine Immune Sciences, a Seattle-based biotech focused on inflammatory kidney disease, for around $4.9 billion in cash. Gilead’s $4.4 billion purchase of liver disease biotech CymaBay was the largest M&A deal before Thursday. And a week ago, Genmab made it's largest-ever buy, scooping up cancer drug developer ProfoundBio.2

Vertex is set to get ahold of Alpine’s lead asset, povetacicept, a dual B cell cytokine agonist that Alpine says has best-in-class potential as a treatment for IgA nephropathy (IgAN).

Why it matters: Meanwhile, also in IgAN, Novartis is working on several assets, including Fabhalta and atrasentan, which the Swiss pharma obtained from its $3.2 billion acquisition of Chinook Therapeutics last year. Calliditas Therapeutics in December gained a full FDA approval for Tarpeyo in IgAN.

3. People are (quietly) grappling with participation in KCC models following steeper-than-expected benchmark adjustments.

I won’t belabor this one because there’s a lot we still don’t know about how this will play out over the next few weeks. There’s a good chance things are already in motion that we just won’t know about until it goes public.

I’m including this deep dive only to point you to my policy updates above and open my inbox for those who want to share what’s on your mind, what you’re hearing, and what people need to know. My (virtual) door is always open and your tips are always anonymous by default.

Visuals of the Month

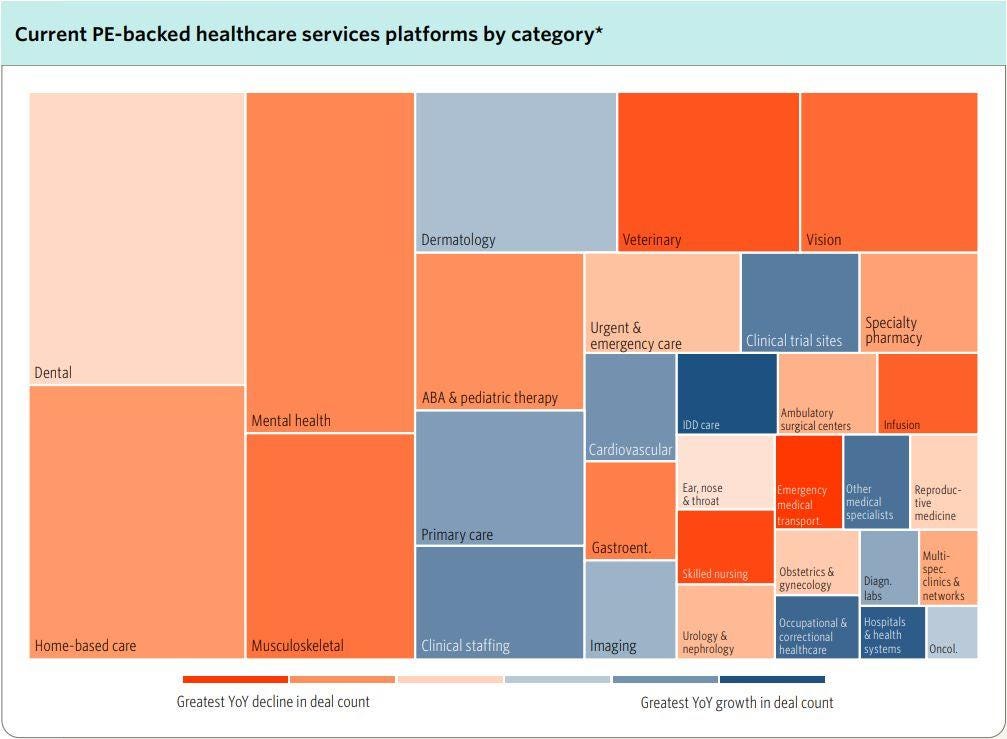

Pictures say a thousand words. What does this PitchBook data tell us about PE-backed healthcare services across the Kidneyverse? These data show that home-based care, mental health, and dentistry are areas that have the most PE-backed groups currently. (h/t Matt Weeks for flagging)

I’d be remiss not to re-mention Blake Madden here, who recently put out this in-depth look at the good and bad of PE in healthcare, and where we go from here.

Want to support my work?

Thanks for tuning in this week. If you enjoy these doses of optimism and news from the Kidneyverse, consider becoming a free or paid subscriber to support my work!

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

Thanks for sharing the Kire TIVBC content! So much opportunity for improvement along that pathway.