"If it looks like a bubble, it may pop like one, too."

Data from SVB shows another (mostly) rough year for healthcare funding

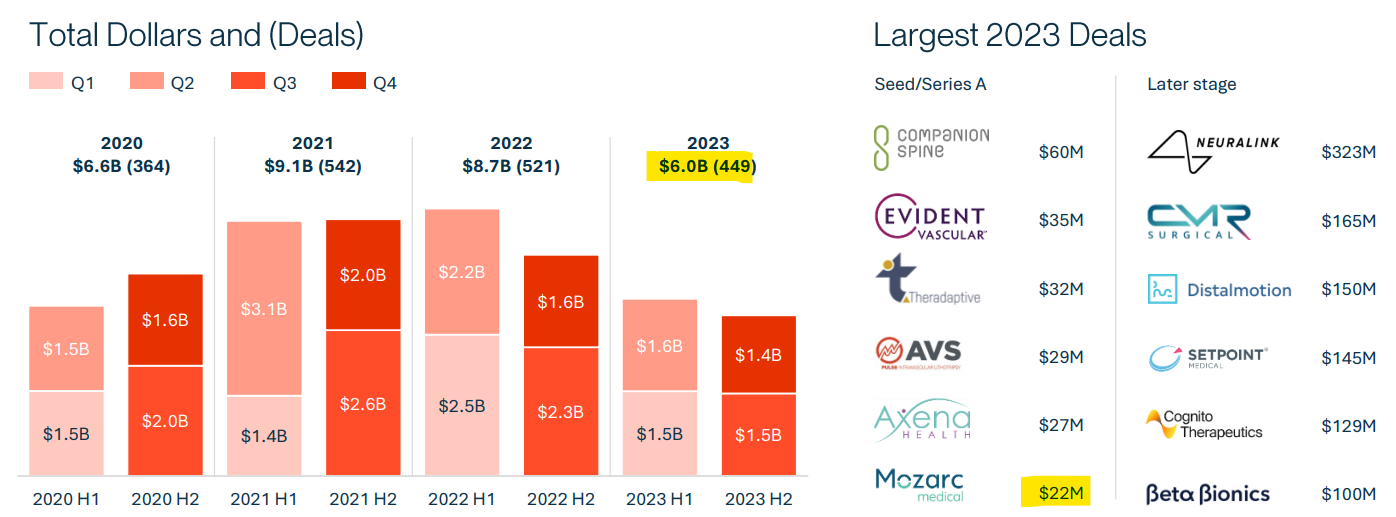

If you followed headlines last year, you might think it was a banner year for kidney care innovation thanks to a few value-based care megadeals and newly announced ventures like Vantive and Mozarc.

You’re not wrong.

Those are all exciting, positive signals about what’s in store for 2024.

But it’s also incomplete. A more complete picture of what’s really going on in private and public healthcare markets, including the Kidneyverse, requires placing these outlier events in the context of the broader healthcare capital markets.

Today we break-down a few key trends in Silicon Valley Bank’s latest Healthcare Investments & Exits Report— and what they might mean for kidney care in the months and quarters ahead.1

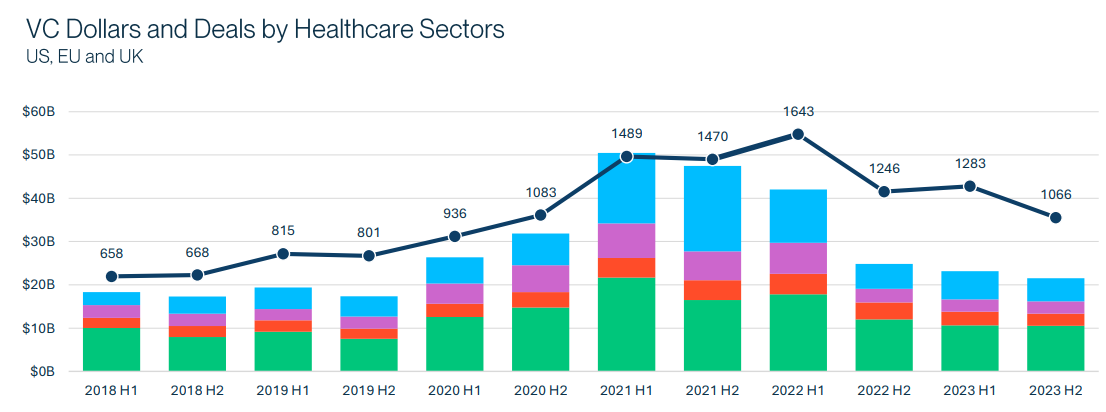

VC Deals by Healthcare Sectors

There are three segments in focus today: healthtech (blue), diagnostics (purple), and devices (red).

(Don’t worry, biopharma deserves its own post.)

All told, US investors raised $19B for new health-focused VC and growth funds in 2023— the third highest amount for any year. This may signal optimism that deployment will pick up as inflation eases and the “soft landing” continues.

Here’s what happened last year— and what it means for 2024.

Contents

Healthtech

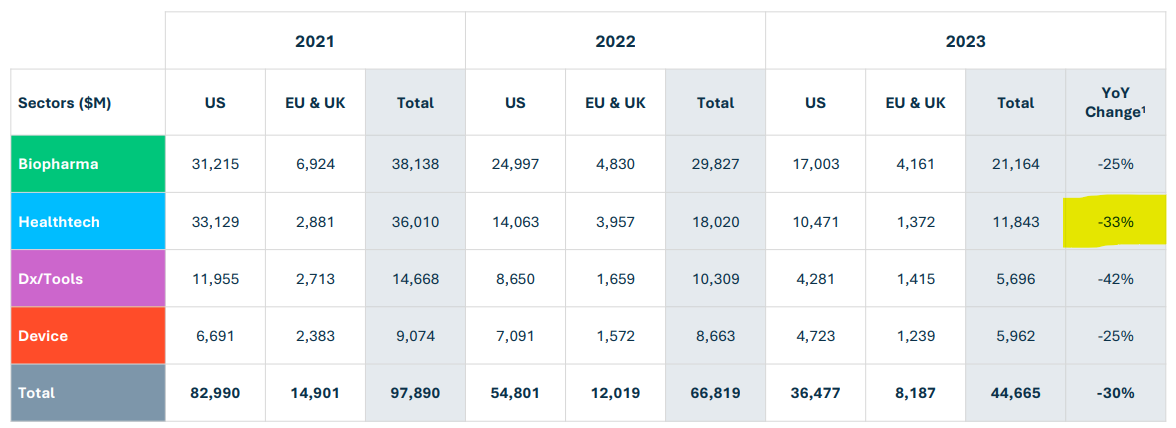

Healthtech companies are still recovering from the over-abundance of interest received during the pandemic (orange underline below), with investment down 33% from 2022 (above).

The 5 largest healthtech deals of 2023 raised a whopping $2.4+ billion, and 4 of them are in our Kidneyverse: Monogram ($375M), Main Street ($315M), Aledade ($260M), and Strive ($166M).

That might account for one-fifth of 2023 healthtech funding, but less than seven percent of 2021’s monster $36 billion total across ~1,000 deals (where all that ‘bubble’ talk comes from).

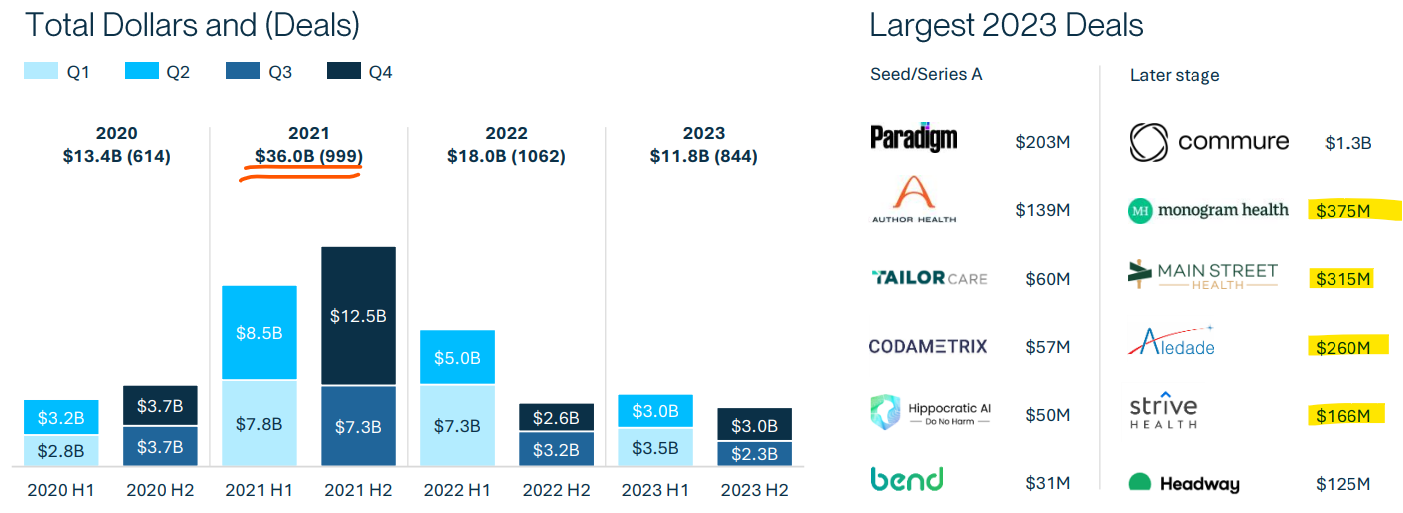

And while later stage companies face challenges growing into their lofty valuations, acquisitions remain steady. Though, there are fewer disclosed deals (dark blue below), reflecting the strained environment that many of these once highly valued companies now find themselves in.

At least 117 VC-backed healthtech companies were acquired in 2023, but only about 19% of the deals disclosed the price, which may suggest many of the deals favored buyers.

These undisclosed deals had a knock-on effect on the tally of total exit value, which fell to its lowest reported total in at least six years (right side).

Diagnostics

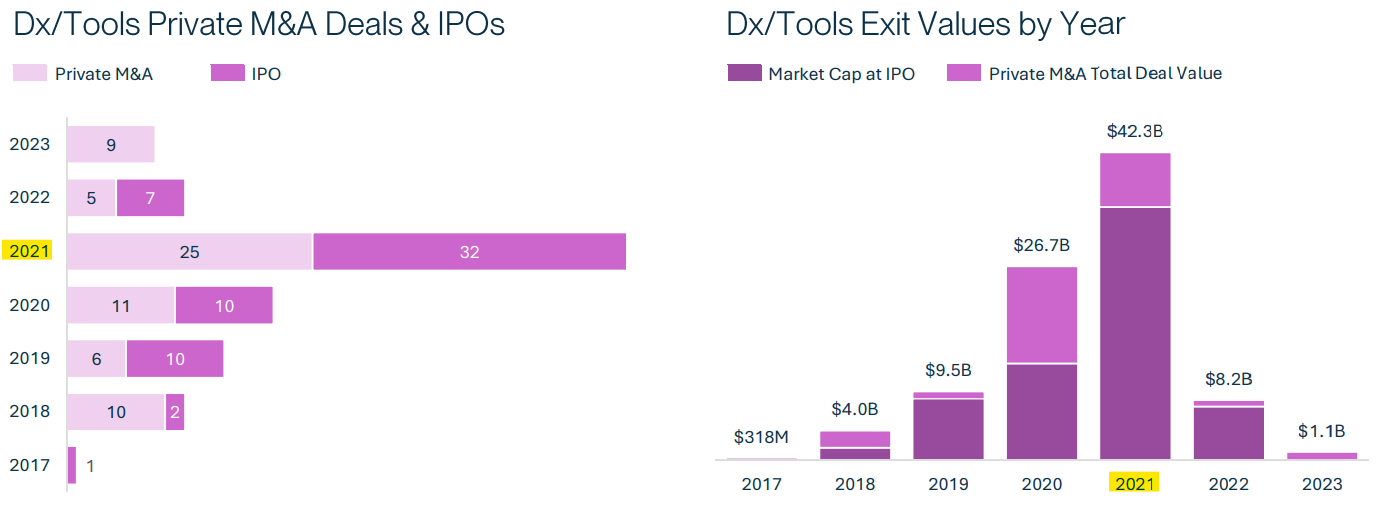

After a gangbuster 2021 and modest 2022, diagnostics IPOs came to a grinding halt in 2023. This marks the sector’s first year since 2016 with no IPOs.

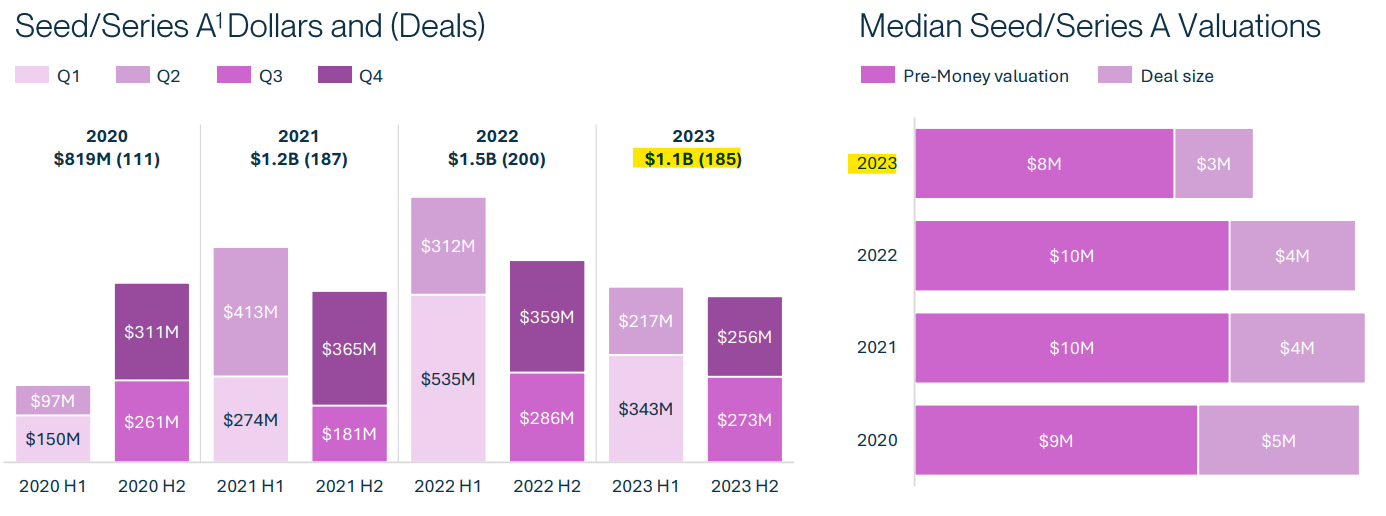

A bright spot in private diagnostics investments is the total capital invested in seed/Series A companies which, while short of the peak in 2022, far exceeds pre-pandemic levels (below).

Similar to healthtech, the diagnostic tools sector is also facing a tougher environment post-COVID.

Demand spiked for disease testing and diagnostics capabilities during the pandemic.

In 2021, a staggering 32 diagnostics companies went public through IPOs, an amount more than all other years since 2017 combined (see below).

Devices

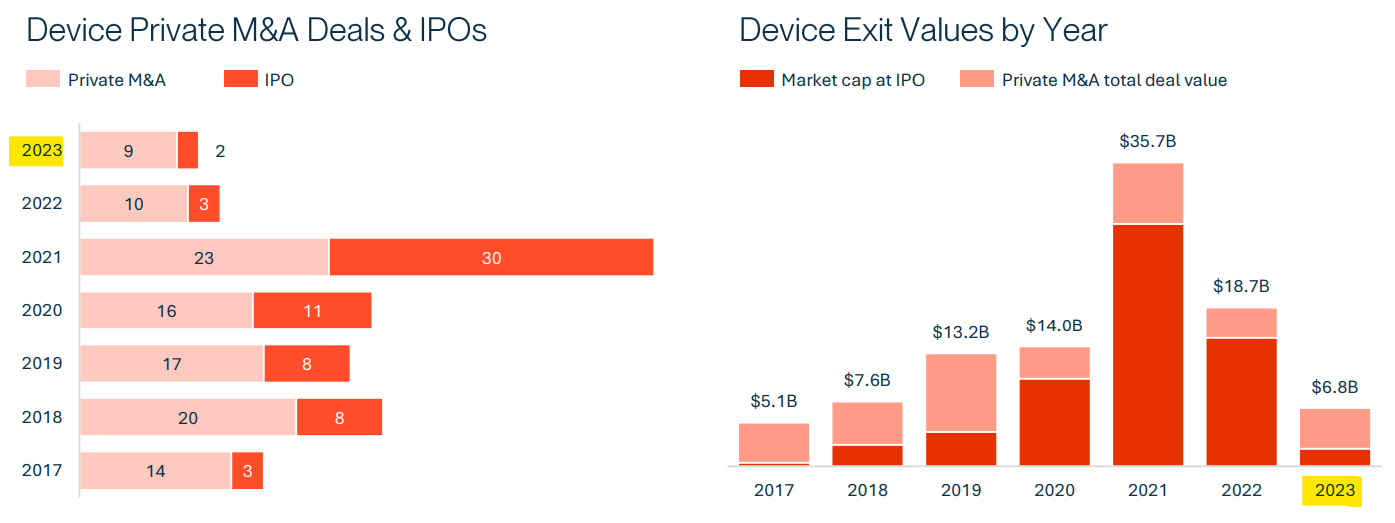

Given the reliance on outpatient procedures, the medical device sector is still working through knock-on effects of the pandemic, including halted procedures and disrupted supply chains.

This manifested as a tough year for device exits when total exit values are at their lowest point since 2017 (below).

Investments have fared relatively well. They’re down 25% from 2022, while diagnostics and healthtech are down 42% and 33%, respectively (see table above).

Within the Kidneyverse, Mozarc is a bright spot in the device segment highlighted here.

Author’s note: By last count, I’m tracking ~30 early stage device companies. Here’s hoping we see more device M&A in non-invasive monitoring and in-home care over the next 5-year stretch. If you’re building in this space, please reach out and say hello.

Funding Trends

Before we wrap up, let’s revisit a couple 2023 funding themes touched on above that deserve more attention: valuations and geographies. That is, how much startup valuations have fallen since 2021 (by stage), and where healthcare startups are raising the most money (by segment).

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)