Signals Brief: Humana's Value-Based Kidney Report

How Humana's VBC partnerships are impacting costs and outcomes for over 77,000 lives across the country

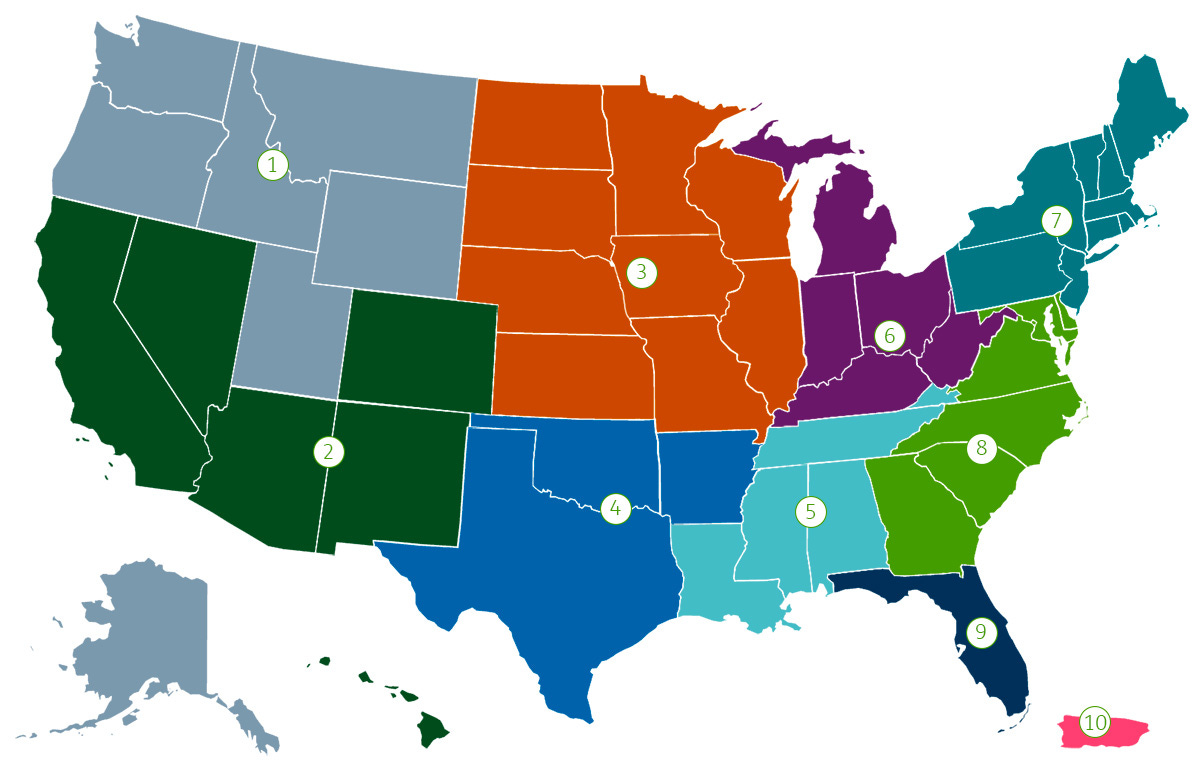

Last week, Humana published a report (PDF) detailing outcomes from its value-based kidney care programs and partnerships, which impact over 77,000 patients nationwide.

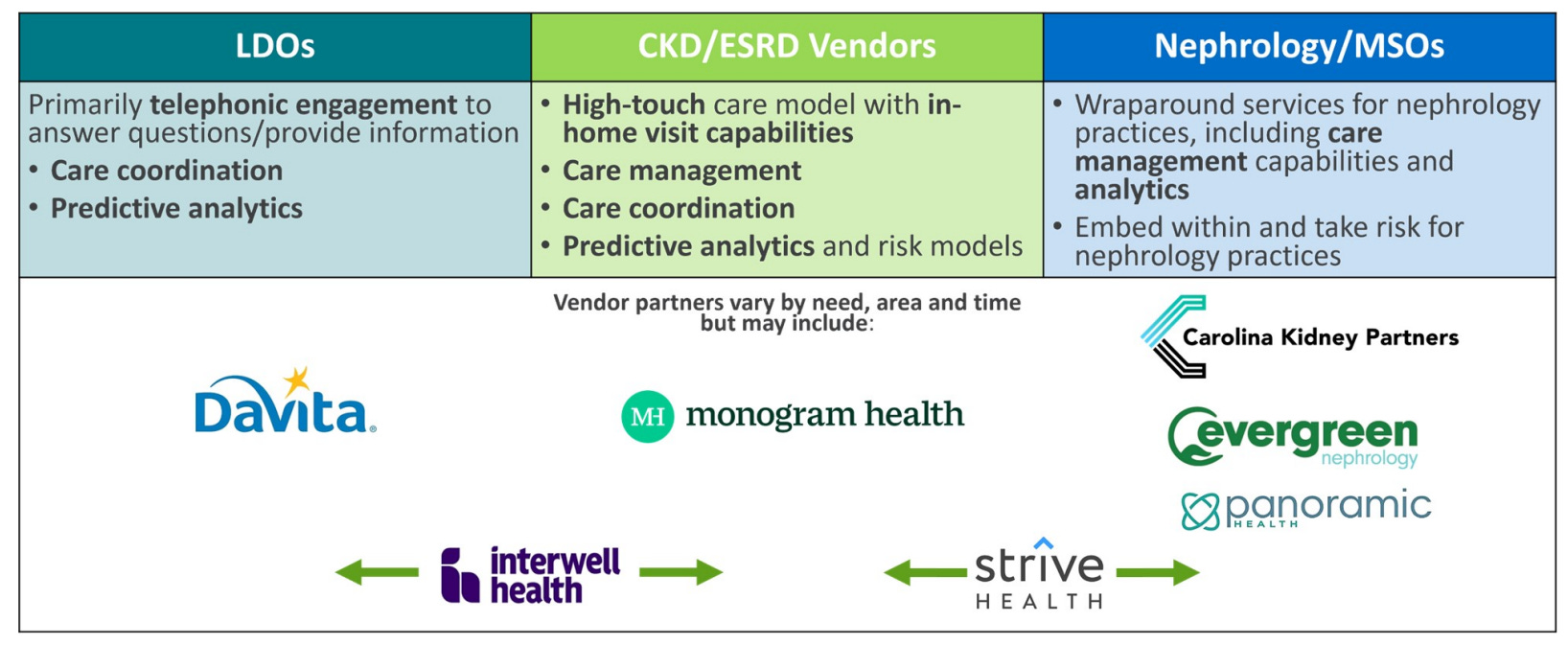

The report includes outcomes across partnerships with specialty VBC providers like Evergreen Nephrology, Interwell Health, Monogram Health and Strive Health, along with large dialysis providers DaVita and Fresenius.

The table below (from page 6) shows us why Humana is positioned to grow VBC partnerships, accelerate development of value-based capabilities and align good clinical models with proper economic incentivization.

But what does that mean, and how do these partnerships actually work?…

How these VBC partnerships work

Each of these companies serves Humana-covered patients by collaborating with / managing kidney care providers while providing wrap-around support and staffing, patient and family education, preventative measures and in-home services, and medication reviews.

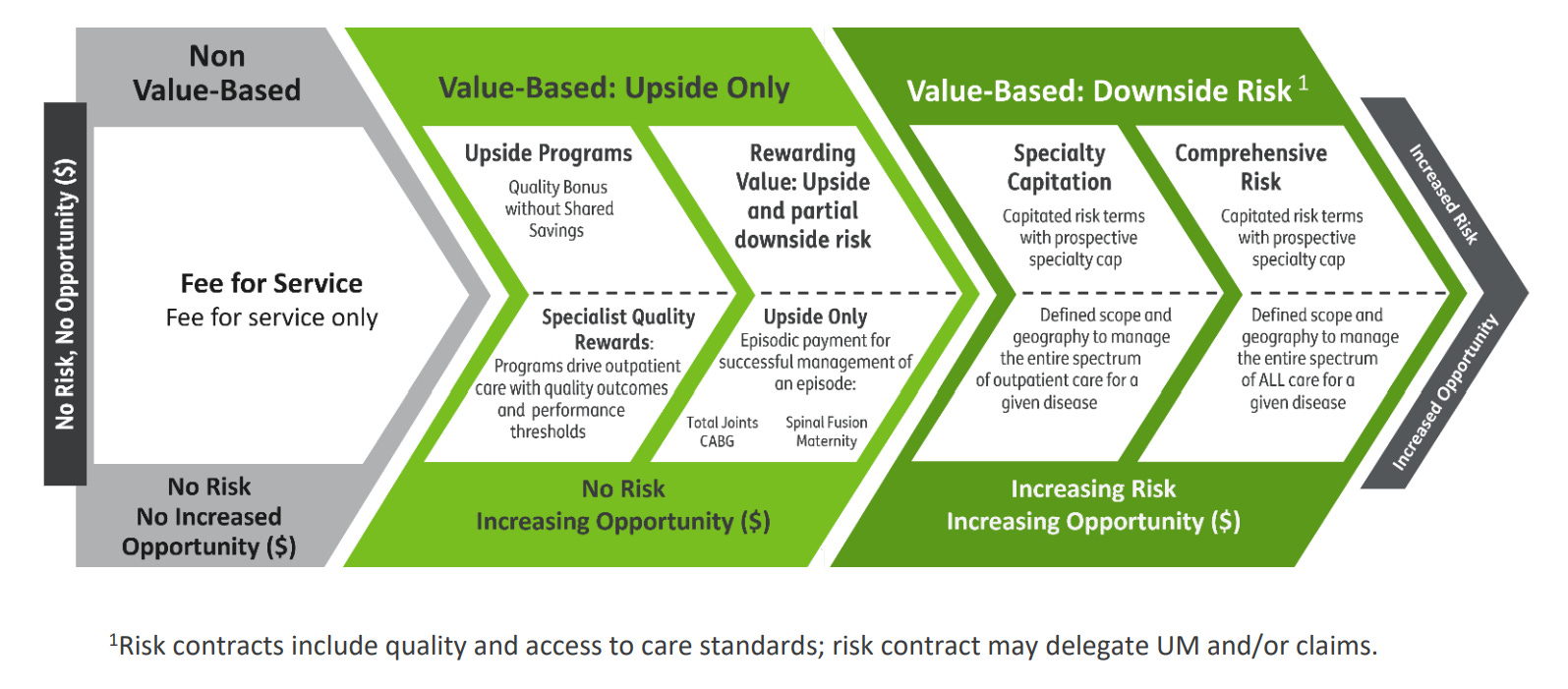

Through what is called a Total Cost of Care (TCOC) contract, Humana, the kidney-focused healthcare management companies, nephrologists, and other providers agree to key performance metrics on which financial incentives are based.

Partners have access to billing claims for hospitalizations, medications, procedures and labs on each patient, which enables a patient care episode with a transparent window for coordination of care.

In most nephrology VBC cases, the provider is compensated to deliver care during the whole patient care episode. Additional financial rewards can be earned if certain quality metrics are met (e.g. TCOC, GDMT, optimal starts, transplants).

As clinicians move from FFS to VBC, they assume increasing accountability for cost and quality. Higher levels of risk mean the financial incentives are more closely aligned with the provision of high-quality care and patient health outcomes; stated plainly, clinicians are financially incentivized to “do the right thing.” — Pg. 9

Outcomes

When comparing 2023 Humana MA patients aligned to VBC nephrology programs versus patients aligned to fee-for-service clinicians, there were 5% fewer unnecessary hospital admissions.

In 2019, Humana CKD patients had a Medical Expense Ratio (MER) over 100%, but as VBC engagement has increased, MER dropped to 88% over 5 years.

Across all Humana VB programs they've seen -(7.1%) fewer admissions than non-value-based care Medicare Advantage, saving 50,000 admissions or 353,000 inpatient days.

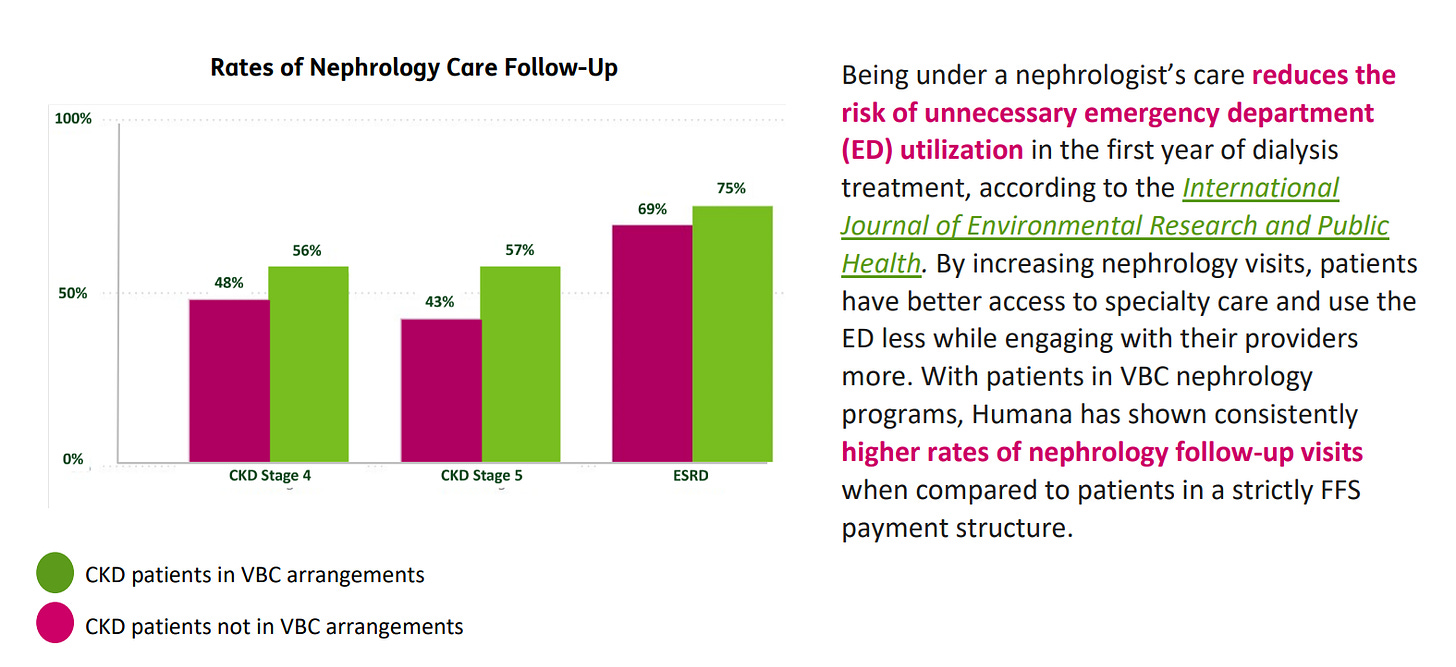

With patients in VBC nephrology programs, Humana has shown consistently higher rates of nephrology follow-up visits when compared to patients in a strictly FFS payment structure (see below).

Discussion

I want to point out a couple things as we open up the discussion here. First, this Signals Brief is meant to call your attention to the main brief written and published by the Humana team — all data and visuals in this issue come directly from that brief. Second, I recognize that there are more players in this space than are called out by name (or logo) in the brief itself. For a full list of VBKC companies and capabilities I’m tracking, please see my latest table and let me know what I’m missing.

If you have comments on any of these data or partnerships, including those with Strive, Interwell, Monogram and others, please leave a comment below or send me a note directly here.

Thank you for being here. I’d love to hear from you below if you have thoughts on these programs, outcomes, or lessons from recent VBC history.

Keep exploring,

— Tim

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

Hi, Tim.

Some of my thoughts:

The debate on Humana’s approach to value-based care centers on the potential challenges and limitations of implementing such a model effectively. While the report showcases positive outcomes, there are several issues that need to be addressed to ensure the model's success. Here’s a detailed analysis of the critical points of contention:

1. Complexity of Implementation

Issue: Implementing VBC requires significant changes in care delivery and management, involving new processes, technologies, and extensive training.

Difficulty: Aligning multiple stakeholders (physicians, care managers, patients) with diverse interests can be challenging, leading to potential resistance and slow adoption.

2. Financial Risks for Providers

Issue: VBC models place financial risk on providers, who are held accountable for patient outcomes and cost management.

Difficulty: Smaller practices may lack the financial stability to manage this risk, potentially leading to closures or consolidation, which could reduce patient access to care.

3. Data Management and Integration

Issue: Effective VBC requires robust data management and integration across various healthcare providers and systems.

Difficulty: Inconsistent data quality, lack of interoperability, and privacy concerns can hinder the seamless flow of information, affecting care coordination and outcomes.

4. Patient Engagement and Education

Issue: Successful VBC depends on active patient participation in their care.

Difficulty: Ensuring patients are adequately educated and engaged can be difficult, particularly for those with low health literacy or socio-economic barriers.

5. Measuring Quality and Outcomes

Issue: Establishing and tracking meaningful quality metrics is crucial for VBC success.

Difficulty: Metrics may not fully capture the complexity of patient care, leading to potential gaming of the system or unintended consequences.

While Humana's value-based care model shows promising outcomes in reducing costs and improving patient care, there are significant challenges related to implementation complexity, financial risks, data management, patient engagement, and quality measurement that need to be addressed to ensure a transformative model of value-based care.