Visual Update: Value-Based Kidney Care

Before we check in on where things stand 1H24, we need your help to get it right.

Welcome to the calm before the storm a preview of coming attractions.

We are preparing our update on where things stand in value-based kidney care in the first half of 2024. Before we can publish our next installment of where things stand — especially around headcount changes, performance and participation in risk-based models following recent benchmark adjustments — we need your help to get this right.

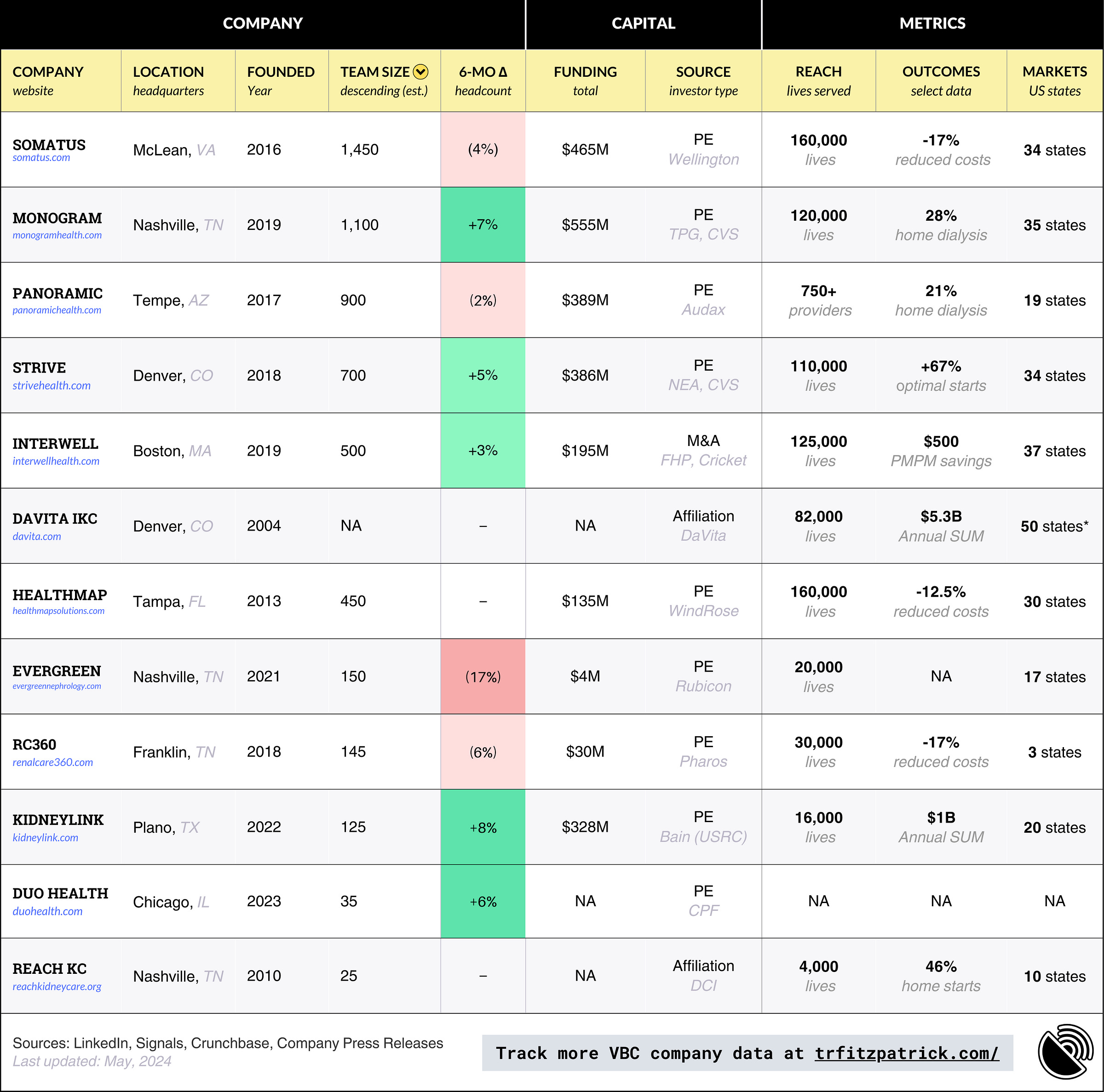

Late last year I put together the first version of the VB kidney care table to help us keep track of key players in the space, as well as their capital partners and traction.

Then, in early February, we published a piece on Kidney Care Choices (KCC) Model participants for 2024, which included 123 participants, over 9,200 providers, and more than 280,000 beneficiaries.

Today, I’m sharing the “first draft” of our VB Kidney Care Table, Version 2.0.

Request for Feedback

Please take a moment to review the table below. If you have an update, especially in areas with missing or incorrect information, please hit reply or send me an anonymous note.

Discussion

What are you seeing and hearing in this space right now? We will use the full post and updated graphic to expand on new additions and momentum changes, including DaVita’s first breakout of their IKC business in Q1 results: 68,600 patients in risk-based integrated care arrangements (around $5.3 billion in annualized spend) + 14,200 patients in other integrated care arrangements.

Please know my inbox is always open, and Kidneyverse Careers exists to help you find your next role or key hire.

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)