Signals Brief: Protecting Patient Choice—The Ardelyx Lawsuit Against CMS and the Fight For Innovation Beyond The Bundle

How a lawsuit brought by Ardelyx, AAKP, and NMQF put phosphate binders front and center in the ongoing debate on paying for US kidney care

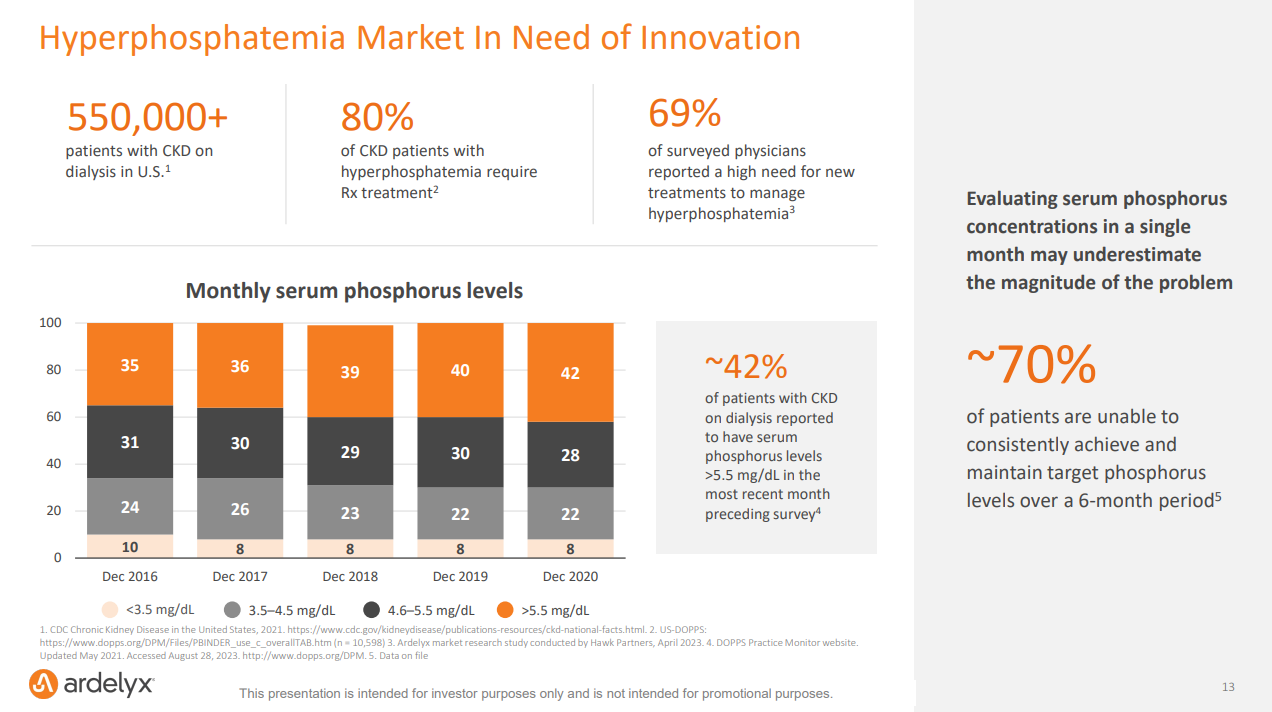

Ardelyx, a Massachusetts-based biopharma company, has filed a lawsuit against the Centers for Medicare and Medicaid Services (CMS) to prevent the inclusion of oral phosphate-lowering therapies (PLTs) in the End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) bundle. The company partnered with the American Association of Kidney Patients (AAKP) and the National Minority Quality Forum (NMQF) to argue that this CMS decision limits patient choice and access to new, effective treatments for hyperphosphatemia, a condition characterized by high phosphate levels in the blood commonly seen in patients with kidney failure.1

If you’re like me, you might be thinking: wait, why would including these drugs in the CMS bundle be a bad thing for patients? On the surface, bundling seems beneficial, and potentially reduces costs. And yet, doing so might stifle innovation and restrict access to cutting-edge treatments by lumping them into a fixed payment system.

Stay with me. This lawsuit is just the latest chapter in a long, harrowing story about the inclusion of these types of drugs in the dialysis bundle, as well as one company’s resilience in the face of a roiling regulatory rollercoaster. In typical Signals fashion, today we’ll talk about what’s happening, why it matters, what’s at stake, and where we go from here.

Background

Resilience, Inc.

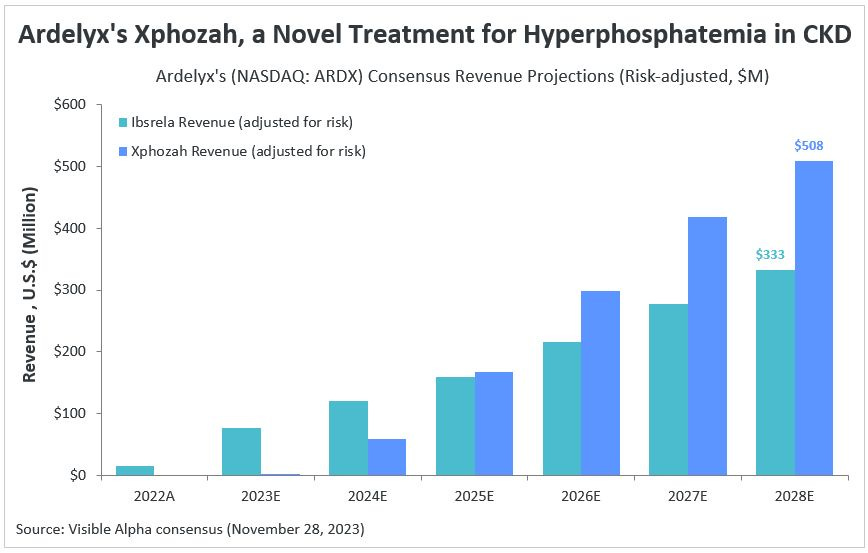

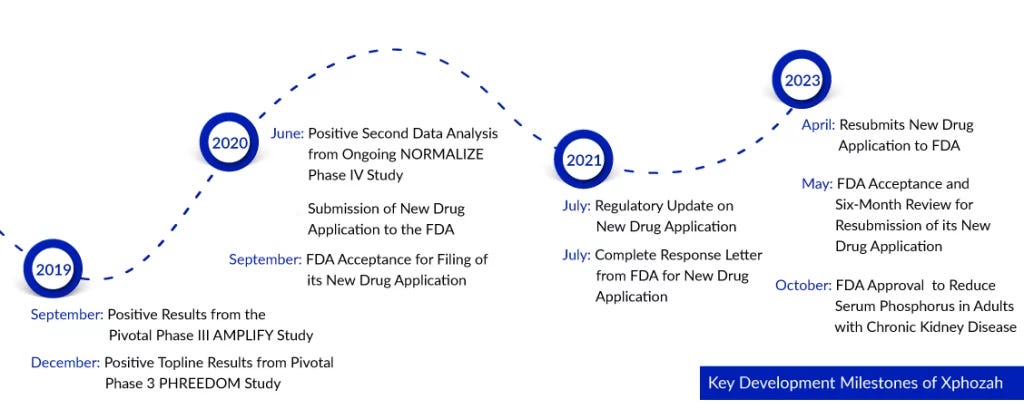

In October 2023, following two painful years marked by multiple surprise rejections and deep layoffs, the FDA approved Ardelyx's drug Xphozah for treating high phosphate levels in adults with chronic kidney disease. A month later, Xphozah was granted Orphan Drug Designation for treating pediatrics, a significant step forward in expanding treatment options for younger patients. Last quarter, Ardelyx reported $37 million in sales for Xphozah— nearly doubling its 1Q 2024 revenues as it continues to pour resources into commercialization to meet market demand. Considering hyperphosphatemia affects 50% to 74% of kidney failure patients, that’s a lot of demand.23

This phoenix-rising background sets the stage for understanding the lawsuit's implications on the broader regulatory landscape.

Regulatory Landscape

The CMS decision to include oral PLTs like Xphozah in the ESRD PPS bundle has been contentious to say the least. Here’s how it works: Patients experiencing kidney failure rely on dialysis and other treatments for life-sustaining care. CMS pays dialysis organizations for this care with a bundled payment that includes dialysis, certain drugs, and other costs like lab work. Currently, oral drugs are not part of the bundle. CMS plans to add them in 2025, which may require dialysis organizations to expand their capacity to dispense high volumes of the drugs. Ultimately, CMS plans to assess whether the bundled payment adequately covers the cost of phosphate binders.45

Congress has previously intervened numerous times on behalf of the kidney community to delay the inclusion of oral drugs until 2025— and legislation has been introduced to further delay this inclusion until 2033. CMS sees things differently, sharing:

“We expect that incorporation of oral-only drugs and biological products into the ESRD PPS will increase access to these drugs, as we have seen previously that incorporating Medicare Part D drugs into the ESRD PPS has had a significant positive effect on expanding access to such drugs for beneficiaries who do not have Medicare Part D coverage, with significant positive health equity impacts.”

Why It Matters

This decision is significant because it affects not only the financial landscape for dialysis providers but also the accessibility of innovative treatments for patients with chronic kidney disease.

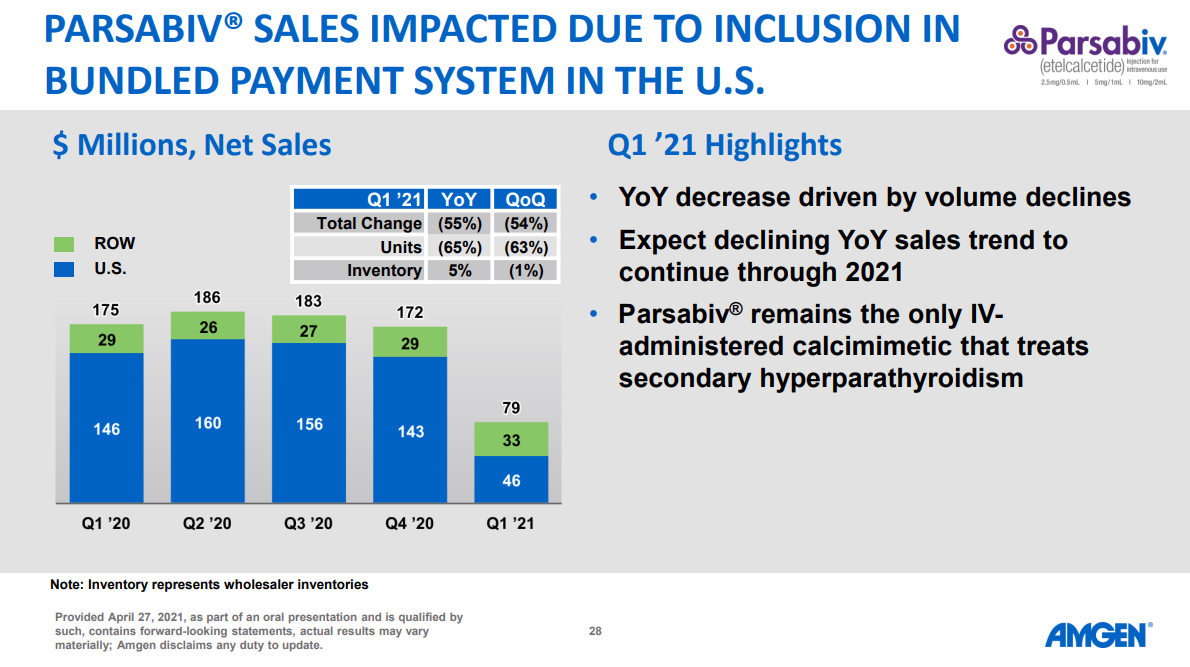

Patient Access and Choice: Integrating these drugs into the bundle could limit patient access to newer, more effective treatments like Xphozah, particularly if the bundled payment doesn't adequately cover the costs. If that does turn out the case, we’ve seen this movie before, including more recently with calcimimetics and Amgen’s Parsabiv performance following bundle inclusion (55% decrease year over year, driven by 65% volume declines — see below).

Clinical Outcomes: The addition of oral therapies to the bundle could incentivize providers to focus on cost management over patient-specific treatment needs. This shift might adversely affect clinical outcomes, as cost considerations could take precedence over personalized care plans that prioritize efficacy and patient well-being. And that’s before considering how the care model itself might constrain (or enable) these population- and patient-level decisions, like in the case of value-based care or national provider networks whose protocols dictate the delivery of these therapies.

Economic Implications: For companies like Ardelyx, the inclusion of oral phosphate binders in the bundle could drastically alter the market dynamics and commercial potential. The projected revenue for Xphozah— which some estimate will surpass $500 million by 2028— might be jeopardized if the reimbursement model doesn't align with the cost of providing this novel therapy.

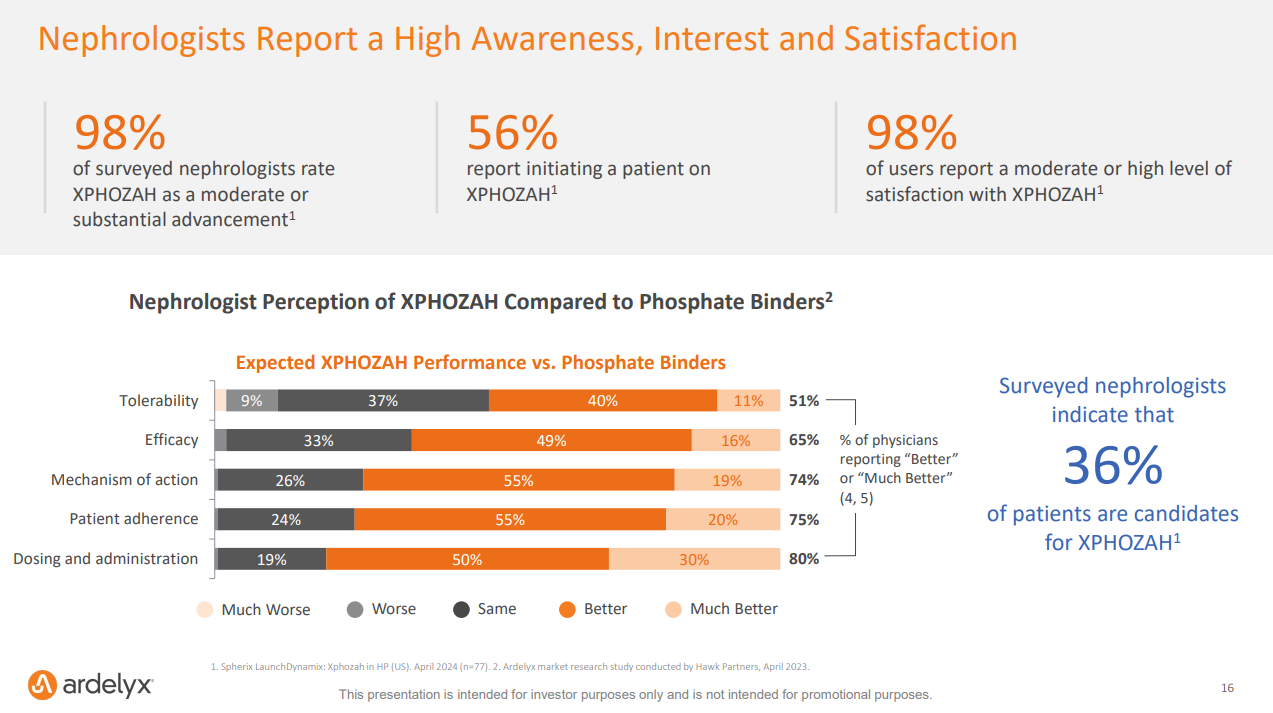

“Among the 77 nephrologists surveyed, 98% rate XPHOZAH as an advance over currently available hyperphosphatemia therapies. 56% of surveyed nephrologists report initiating a patient on XPHOZAH, and among those reported users, 98% report satisfaction with treatment.” — Spherix Global Insights

Bigger Picture

This lawsuit and the ongoing legislative efforts underscore the broader challenges in balancing cost-containment strategies with the need for innovation in healthcare.

Regulatory Challenges: Ardelyx’s battle with the FDA over Xphozah’s approval highlights the difficulties biopharmaceutical companies face when introducing new treatments. The truth is, it’s hard to make new drugs— and getting harder each year. AI may have something to say about that soon, but for now you’re still looking at 10 to 15 years to bring a single new drug to market, and over $200 billion spent each year on pharma R&D. The lengthy approval process and the need for congressional intervention illustrate the complexities of navigating regulatory frameworks while bringing new therapies to market.

Cost Control: The situation reflects a recurring tension in healthcare: the need to foster innovation and introduce advanced therapies while maintaining fiscal responsibility. Roughly 1 in 5 Medicare dollars is spent on kidney care each year in the US. At the same time, those who live with kidney failure are 1% of the U.S. Medicare population but account for 7% of the Medicare budget. Clearly, we need to find better (cheaper, safer, more effective) ways of treating kidney diseases in this country. We cannot afford to continue down this path.

Impact on Other Therapeutics: The outcome of this case could set a precedent for other oral drugs and innovative treatments in the ESRD bundle, potentially influencing how future drugs (or devices?) are incorporated into bundled payment systems and impacting the broader nephrology landscape. If nephrologists say 36% of their patients are candidates for Xphozah— how many of those patients will end up using this therapy? How will the eventual CMS decision impact that total number, for better or worse?

What To Watch

The progress of this lawsuit will be crucial in determining the future of how oral drugs are handled within the ESRD payment structure. Keep an eye on congressional efforts to delay the inclusion of oral drugs in the bundle until 2033.

Feedback from the kidney community (and people like you!) will indicate and inform broader impact of these regulatory changes on patient care.

Discussion

This lawsuit opens up a broader conversation about the role of regulatory bodies in healthcare and the balance between cost control and patient access.

Balancing Innovation and Cost: How can the healthcare system balance the need for innovative treatments with cost-containment measures? What strategies can be implemented to ensure patient access to cutting-edge therapies while managing healthcare expenses?

War, what is it good for: The battle continues. What role should regulators play in shaping healthcare policy, particularly in cases where regulatory decisions may impact patient access and treatment options? In those cases, how do we get it right? What examples can we point to for how this could and should look?

Future of Value-Based Care: How can value-based care models adapt to incorporate new therapies without compromising patient outcomes or provider sustainability? Is innovation inherently part of the “value” in these care models? If not, why not?

Timeline for intravenous options: Do we have a rough timeline on when IV options may be approved (or submitted)? Who is working on this?

In our first Signals Live audio event, both Terry Litchfield and Anthony Rodriguez highlighted the challenges of reimbursement in the innovation equation. They also made a clear case for joining AAKP as one of our best available actions for elevating these causes to reach the policymakers and regulators who can take action.

Thank you for being here. If this conversation resonates, or if you have a story or point of view to share, we’d love to hear from you in the comments below.

Keep exploring,

— Tim

Resources & Data

GAO Report: CMS Plans for Including Phosphate Binders in the Bundled Payment. A recent GAO report includes interviews from CMS officials, five large dialysis organizations that comprised over 85 percent of dialysis facilities in fiscal year 2022, an association representing over 100 small dialysis organizations, and associations representing nephrologists and dialysis patients.

H.R.5074 - Kidney PATIENT Act of 2023. This bill delays a change to the payment methodology under Medicare for oral drugs that are used to treat end-stage renal disease (ESRD).

Kidney Care Partners Letter to Congress. The KCP asked Congress to delay the inclusion of oral-only drugs in the ESRD PPS. They argue “Medicare policy should make sure patients receive services from the provider best suited to provide that care. In the case of phosphate binders/ lowering drugs, pharmacies through Part D are the best situated to provide access for individuals who require dialysis.

Prices for and Spending on Specialty Drugs in Medicare Part D and Medicaid: An In-Depth Analysis. In this working paper, the Congressional Budget Office examines the prices paid for specialty drugs and spending on those drugs in Medicare Part D and Medicaid from 2010 to 2015. The KCP Letter above references CBO work on savings from Part D, so I thought this was worth sharing.

Public Comments on the ESRD PPS Proposed Rule. Want to know what people are saying? The public comment period ends in 21 days (on August 26, 2024).

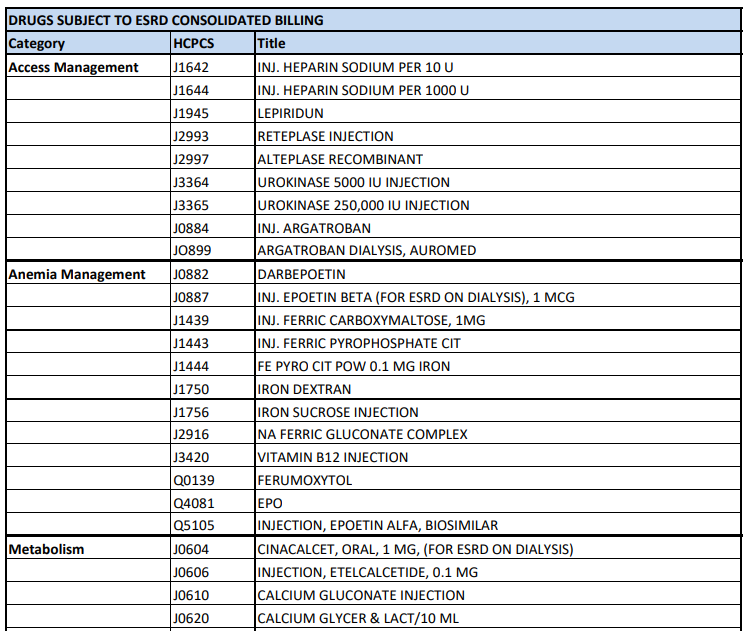

CY 2024 ESRD PPS Consolidated Billing List. A list of supplies, drugs, biologicals and labs included in the ESRD bundled PPS rate effective January 1, 2024. Here is the ESRD PPS Consolidated Billing page where you can find more downloads, reports, and educational resources.

A snippet from the Consolidated Billing page here.

Want to support my work?

Cernaro V, Longhitano E, Casuscelli C, Peritore L, Santoro D. Hyperphosphatemia in Chronic Kidney Disease: The Search for New Treatment Paradigms and the Role of Tenapanor. Int J Nephrol Renovasc Dis. 2024;17:151-161

Leaf DE, Wolf M. A physiologic-based approach to the evaluation of a patient with hyperphosphatemia. Am J Kidney Dis. 2013 Feb;61(2):330-6.

GAO-24-106288: End-Stage Renal Disease: CMS Plans for Including Phosphate Binders in the Bundled Payment — GAO.gov

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

Nice article! We've heard from leaders in dialysis that the incentive to use high-cost but effective therapies once they're in the bundle drops quickly to 0%...