Signals Brief: Going with the FLOW: how new Ozempic data might redefine upstream kidney care

Novo's diabetes drug significantly reduces risk of kidney failure and death for people with diabetes and kidney disease

Hello my friends and fellow explorers,

In today’s brief, we’re talking about the latest trial data on semaglutide. It’s the diabetes and weight loss drug that has once again taken hold of the news cycle. Today, we’re focused on the version of “sema” made by Novo Nordisk and approved to treat type 2 diabetes, called Ozempic. By now you’ve seen Ozempic in news feeds and across pop culture — from Saturday Night Live to the Oscars. Here’s what you need to know about these latest results of the FLOW study, what it means for the Kidneyverse, and what people think happens next.1

Have tips or feedback? Hit reply or join the conversation here.

Reading time: 8 minutes

What happened

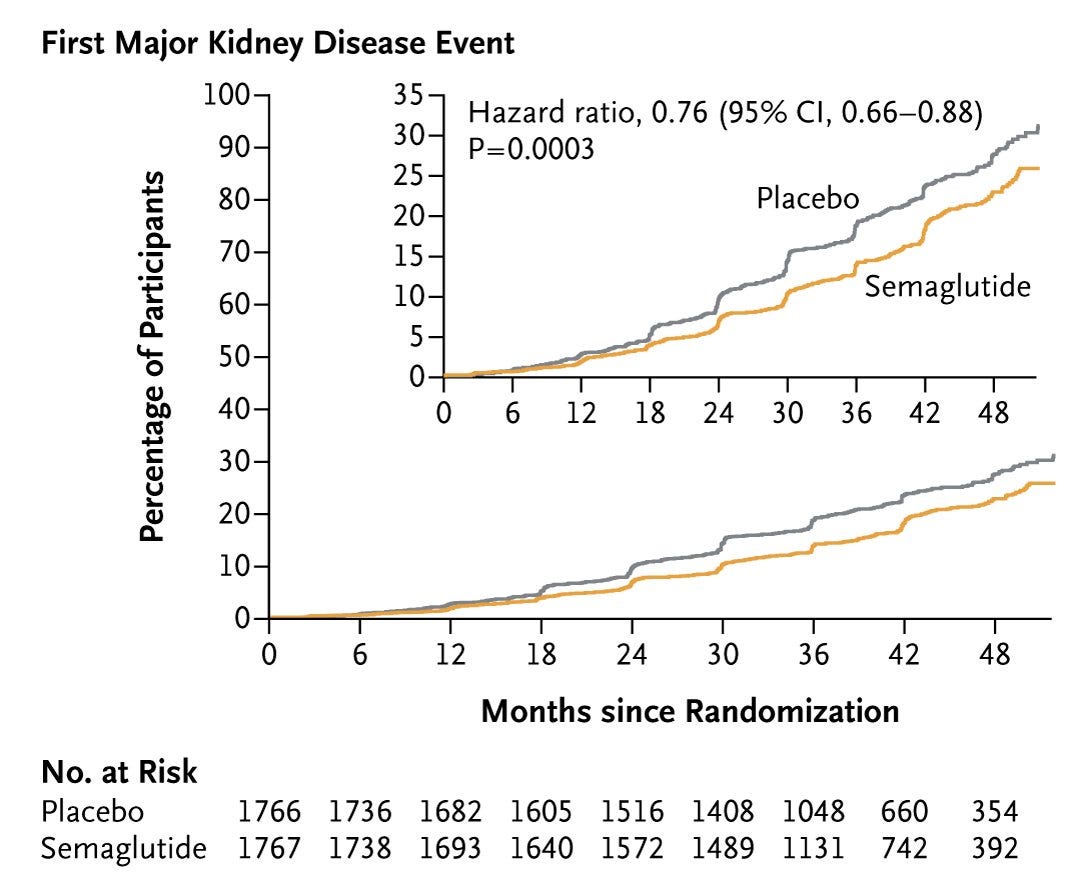

Novo Nordisk just announced full results of its Phase 3 FLOW trial. The study of ~3,500 people showed that Ozempic significantly reduces the risk of kidney disease progression and major heart problems in patients with type 2 diabetes and chronic kidney disease (CKD). Taking 1.0mg of semaglutide weekly, along with regular treatment, helps combat kidney failure, loss of kidney function, and death from kidney or heart problems in people with diabetes and CKD.

Semaglutide helped cut the risk of major cardiovascular events by 18% and reduced the risk of death by 20%. Two months ago, we learned that semaglutide reduces the risk of kidney disease progression and kidney and cardiovascular death by 24%.

This news is hard to overstate, as it has the potential to reshape the entire treatment landscape for millions across the country and around the globe.2

Why it matters

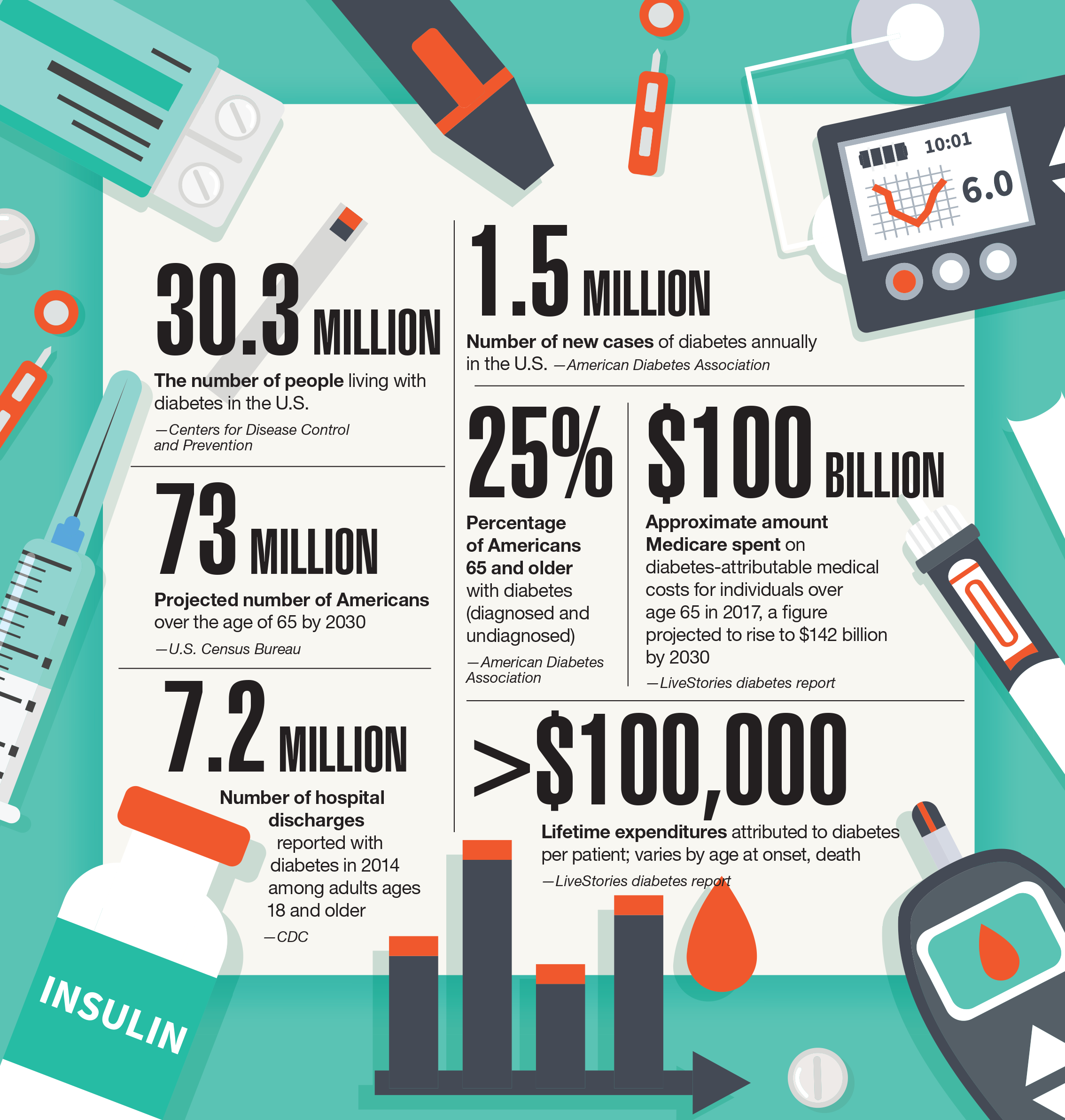

The FLOW trial shows how semaglutide could change how we treat chronic kidney disease in people with type 2 diabetes. For context, around 40% of the type 2 diabetes patient population has kidney disease. Around 30 million people in the US have been diagnosed with diabetes (that’s roughly 9% of the population). In 2022, this led to nearly $307 billion in direct medical costs and $106 billion in reduced productivity. It doesn’t take too much napkin math to back out the unmet need or potential impacts here — on cost, on lives, and on society as a whole.3

Novo Nordisk says it will file for regulatory approvals in the United States and Europe this year to expand Ozempic's label.

“Approximately 40% of people with type 2 diabetes have (CKD), so the positive results from FLOW demonstrate the potential for semaglutide to become the first GLP-1 treatment option for people living with type 2 diabetes and (CKD).”

— Martin Holst Lange, Novo Nordisk EVP for Development

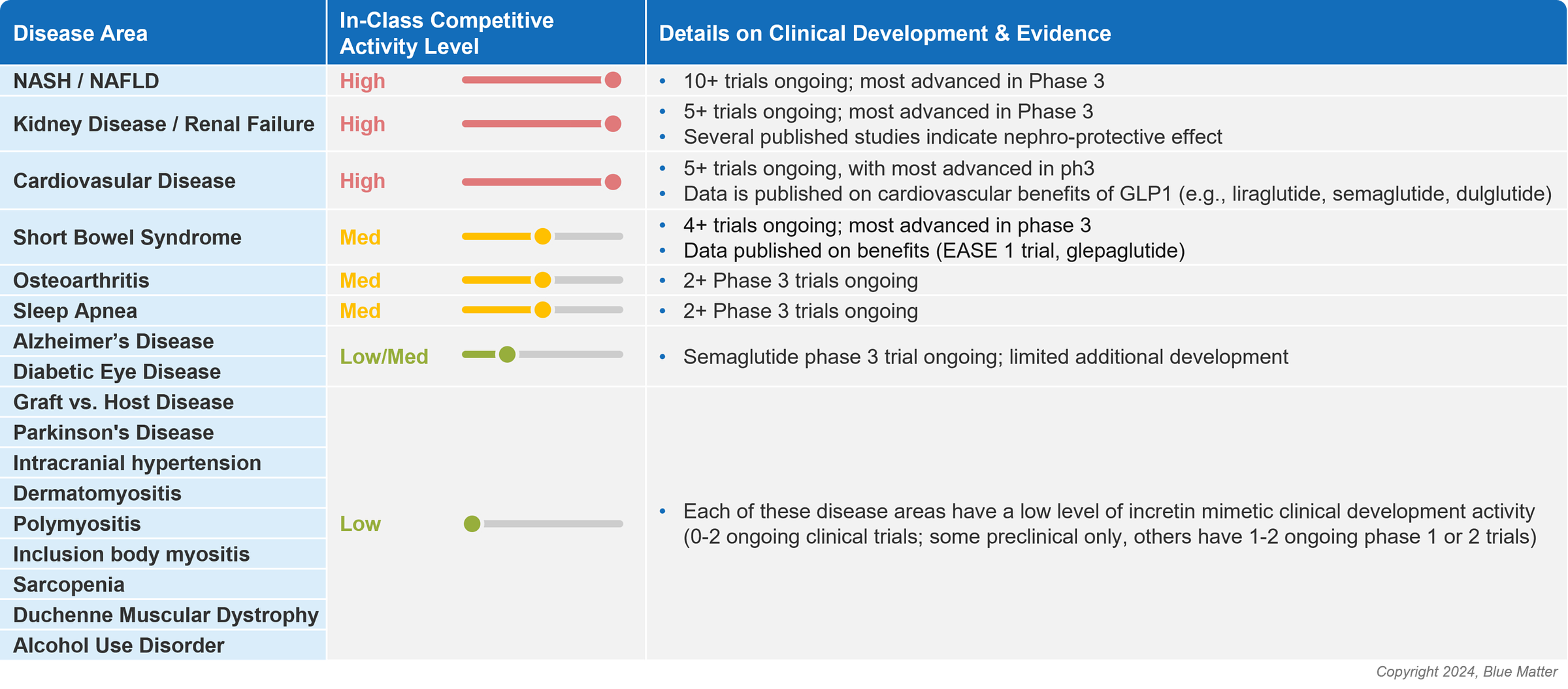

Kidney disease is just one therapeutic area pharma is exploring that represents the so-called “goldilocks zone” of large commercial opportunity and unmet medical need — and Novo is far from alone on that quest.

Just last week, Hims & Hers announced the addition of compounded GLP-1s as a way for its customers to access medications “with the same active ingredient as Ozempic and Wegovy without navigating the shortages and costs that are currently limiting access to the branded medications.”

A GLP-1 report published in January takes a closer look at some of these opportunity areas beyond diabetes and obesity. Kidney disease ranks atop the list along with heart disease and NASH, a liver disease associated with metabolic syndrome.4

What people are saying

Dr. Heather Ratliff shared a post on LinkedIn saying “In the hands of a trained provider and a willing patient this is not about a “quick fix” or “take a shot and eat what you want”….it should be incorporated with lifestyle changes in the areas of nutrition and physical activity but the data is increasingly clear that the benefits of these meds for these patient populations go beyond what we can see on the scale.”

Dr. Andrew Sauer shared the NEJM study in a post on LinkedIn says the standard of care for T2DM and CKD is being redefined. He says he new “four pillars” of therapy for these patients includes: 1. ACEi/ARB; 2. finerenone; 3. SGLT2is; and 4. GLP-1s. He points out that because patients are often on many medications, “we need to be judicious about getting them on the correct ones.”

This Twitter thread by Dr. Muthu Vaduganathan is a helpful dive into some of the key takeaways and endpoints in the study. One salient insight from his thread: “Cardiologists must be key partners in implementation of kidney GDMT in high-risk patients.” Oh, and happy belated birthday, Dr. Tuttle!

Continue learning

AstraZeneca’s Helen Yeh shared newly published data that underscore the need for targeted screening, diagnosis, and early use of guideline-directed treatment (GDMT) in patients at high risk of CKD. The data suggests this could mean 774,800 fewer heart attacks, 554,400 fewer hospitalizations for heart failure events, and 338,200 fewer strokes over 10 years across just 4 European countries (UK, Spain, Germany, and the Netherlands).

Blue Matter’s Mike Gottlieb published a report titled GLP-1s and Beyond: Understanding and Evaluating Incretin Mimetic Market Opportunities. It’s well worth a read to understand the GLP-1 fervor of 2023, the current state of incretin memetics in diabetes and obesity, and other potential therapeutic areas (like CKD) where GLP-1s make sense for patients (and manufacturers).

And if you want to dig even deeper into GLP-1s, consider reading

’s recent piece (and podcast) on the topic with Daniel Drucker, the physician-scientist credited as one of the co-discoverers of GLP-1s nearly 3 decades ago.If you’re not already listening to the Acquired podcast, buckle up, and, you’re welcome. This Novo Nordisk episode is probably the most interesting 4 hours of pharma history you’ve heard in your life. It’s also quite timely — Novo is now the largest company in Europe, surpassing luxury conglomerate LVMH and the entire Danish economy, where Novo is based. For some, this may be a summary and review. For others, it will open your eyes and minds to the significance of this moment, like it did mine. Either way, it’s worth a listen.

Discussion

What’s your take on these trial results? How do you think semaglutide will (or will not) change the way we treat kidney disease and diabetes in the United States by 2030?

Leave a comment below or join the kidney chat and let us know what’s on your mind.

Want to support my work?

Thanks for tuning in. If you enjoy these doses of optimism and news from the Kidneyverse, consider becoming a free or paid subscriber to support my work!

Ozempic and Wegovy are both injections that contain semaglutide. Ozempic is approved to treat Type 2 diabetes. Wegovy is a higher-dose version that’s approved for weight loss. They aren’t interchangeable. Learn more at GoodRx Health

When Novo released trial results in March showing Ozempic can reduce risk of major cardiac arrest and death by 24%, the company’s stock actually fell nearly 2%. It turned out Wall Street expected 30%, a game I remember all too well from my trading days.

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)