Signals Brief: Would you donate a kidney to a stranger... for $50,000?

We're one step closer to paying donors for their kidneys in the US. Here's how it would work, and why it might save taxpayers billions over the next decade.

Kidney care is having another moment. Maybe it never really ended. I’m starting to think the 2019 Executive Order was the proverbial domino that set these events in motion. Call it what you will: an awakening; a reckoning; or kindling, but it feels like not a single week goes by without hearing of another chance to shake up the system. And because of this, I want to reiterate how much I appreciate you bringing these important developments to my attention as they happen. This incredible network of advocates, patients, clinicians, industry leaders and policymakers I’ve met through writing this newsletter is the same source of insight and energy that fuels me to keep learning and writing about what’s next.

Last week, a fellow explorer (and altruistic donor) put a crucial piece of legislation on my radar. I knew it was something we needed to explore here on Signals. Thank you Cody, Elaine, Ned, Matt, and all those who continue to advocate for better futures for patients with kidney failure— and have given their own to advance the cause.

On August 12th, the End Kidney Deaths Act (H.R. 9275) was introduced in Congress, marking a pivotal step toward addressing the organ supply shortage. Representatives Nicole Malliotakis, Josh Harder, and a bipartisan group of colleagues presented the bill, which seeks to amend the National Organ Transplant Act (NOTA), originally passed during the Reagan Administration, to allow financial incentives for living kidney donors. The proposed legislation outlines a ten-year pilot program offering a $10,000 refundable tax credit per year for five years (totaling $50,000) to non-directed living kidney donors who donate to a stranger at the top of the waitlist.1

Currently, there are over 90,000 people in the U.S. waiting for a kidney transplant, and the organ shortage continues to result in thousands of unnecessary deaths each year. By providing financial incentives, this legislation seeks to increase living kidney donations—a gold standard treatment for kidney failure—by reducing financial and logistical barriers for potential donors.2

The potential economic benefits are significant. One estimate shows us that every time someone on Medicare moves from dialysis to a kidney transplant, taxpayers would save half a million dollars. By the end of the ten-year program, the bill could help up to 100,000 Americans receive life-saving kidney transplants, while generating over $30 billion in savings for taxpayers.34

If only this were a purely clinical or economic argument— it is not. As Dr. Axelrod and colleagues point out in their seminal AJT paper from 2018: “Clearly, the economic benefits of LDKT would justify an economic incentive for living donation, should there be an ethically acceptable vehicle for this to be delivered.”

Let’s jump in.

Why It Matters

In the last twelve months, the U.S. kidney transplant system has seen more policy activity than in the previous four decades. The End Kidney Deaths Act could significantly reshape the landscape of kidney donation in this country. Here’s why it matters in the context of the larger system at work:

Economic Impact: In terms of first principles, we know Medicare spends 7% of its budget on patients with end-stage renal disease (ESRD), despite these patients making up only 1% of its members. And yet, only 12% of dialysis patients were on the waitlist for a kidney in 2021. For a gold standard treatment that’s more cost-effective than its alternatives, I wonder how this policy lever might change the calculus of capitalism in favor of clinical outcomes. I doubt Adam Smith predicted his “invisible hand” would ever extend to organ donation, but it just might.5

“Clearly, the economic benefits of living donor kidney transplant would justify an economic incentive for living donation, should there be an ethically acceptable vehicle for this to be delivered.” — Axelrod DA, et al. (2018)

Legislative Precedent: This bill challenges the long-standing prohibition on compensation for organ donation, which has been a key barrier to addressing the organ shortage crisis. By allowing financial incentives, the legislation has the potential to dramatically increase the number of living kidney donations. Fun fact: though it’s been dubbed the “End Kidney Deaths Act,” the actual title of this bill is “To amend the Internal Revenue Code of 1986 to provide a refundable tax credit for non-directed living kidney donations.”6

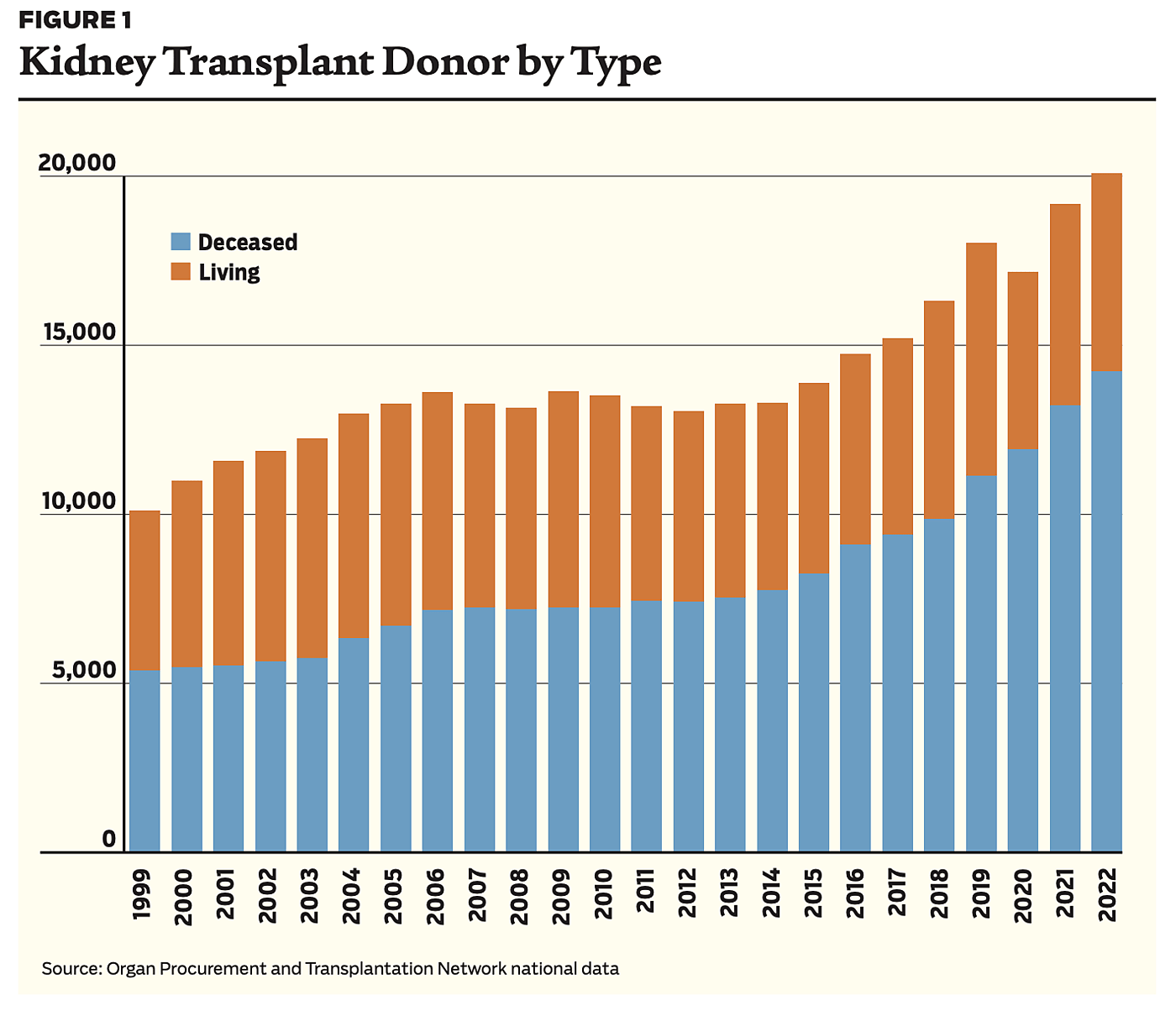

Kidney failure crisis: Nearly 800,000 Americans suffer from kidney failure today, a number expected to reach 1 million by 2030. The current system relies heavily on deceased donors (see the blue stacked bar chart above), but living donations offer better outcomes—living kidneys last longer. Even if the deceased donation system were working at an optimal level, we could only add around 2,000 new kidneys per year, not nearly enough to end the kidney shortage.

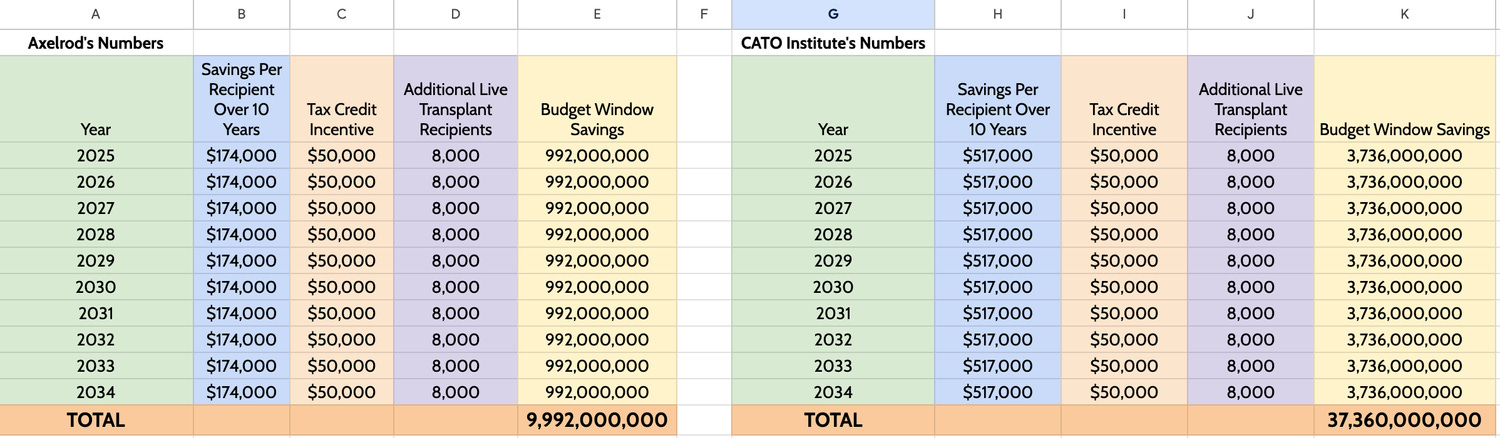

Potential savings: Beyond improving patient outcomes, this tax credit is projected to save taxpayers between $10 billion and $37 billion by reducing the number of patients reliant on dialysis. These estimates are based on savings per recipient between $174,000 and $517,000 from avoided dialysis costs. You can see the two side-by-side calculations below.7

Bigger Picture

This legislation signals a shift in how policymakers view organ donation—moving from a purely altruistic model to one that acknowledges and addresses the financial realities many potential donors face. During NOTA’s creation 40 years ago, Al Gore said that if transplant centers conclude efforts to improve voluntary donation are unsuccessful, incentives including tax credits should be provided to donors.8

Long-term Impact: The bill could result in up to 100,000 additional transplants over the next decade. Here’s why that number is significant: from 2010-2021, 100,000 waitlisted candidates died or became too sick to be transplanted and died on dialysis. Imagine if we could have given every one of those people a new kidney.

Addressing Inequities: The bill could help close the gap in racial disparities in kidney donation by expanding the pool of available kidneys, particularly benefiting patients who lack social networks of potential donors.

Room To Grow. The number of living donors has remained stagnant at around 6,000 for the past 24 years. Only around 300-400 people each year have donated kidneys to strangers. The size of the waitlist has doubled over that time period. Increasing the number of living donors is possible, and perhaps necessary.

A Force Multiplier. Frequently, kidneys from non-directed donors are used to initiate a chain of kidney transplants for incompatible donor-recipient pairs called kidney chains. This multiplies the positive impact of non-directed donation. The longest chain included 114 recipients.

What To Watch

As the bill makes its way through Congress, here are a few things I’ll be tracking—what will you be watching?

Legislative Progress: The speed at which Congress acts to pass the End Kidney Deaths Act is an eternal unknown. Will the bill gain traction and find supporters in the Senate? Will it face delays in committee? Track its progress here.

Ethical Considerations: Public opinion on compensating organ donors will play a role in shaping the debate, as it should. How will policymakers and the public respond to the ethics of offering financial incentives for organ donation? I found this page helpful in terms of understanding myths and common rejections.

Stakeholder Reactions: Advocacy groups, healthcare providers, and patient communities will be watching this one closely. This is another big opportunity to reshape kidney care in this country. I’d love to hear what you think about this topic or the discussion points below.

Discussion

This bill opens up a broader conversation about the role of policy in removing disincentives for living donation— how do you think about these topics?

Financial Incentives in Organ Donation: Are financial incentives the future of organ donation? Are they enough? Does the payment structure alleviate concerns about potential donors doing so out of financial desperation? (See FAQs)

Impact on the Dialysis Industry: If the bill succeeds, how will the dialysis industry adapt? Will we see more cooperation and collaboration to help patients at the top of the waitlist get new kidneys?

Long-Term Healthcare Savings: How significant could the financial savings be for Medicare and taxpayers? Are there other areas of healthcare where similar incentive-based models could work?

Patient Outcomes: Beyond the financial impact, what would this legislation mean for patient outcomes? Can we expect a significant reduction in mortality and improvement in quality of life for kidney patients?

Broader Implications for Healthcare Policy: Could this bill set a precedent for compensating donors of other organs? What might the future hold for similar legislation in other areas of healthcare?

Another week, another weighty topic at the intersection of kidney care, regulation, and patient access. Not all Signals carry such moral and systemic implications, but here we are. These are exciting, consequential times. We’re witnessing a true turning point in kidney care systems in this country. The powers that be are listening—let’s make the most of this moment.

Thank you for being here. If this conversation resonates, or if you have a story or point of view to share, we’d love to hear from you in the comments below.

Keep exploring,

— Tim

Resources & Data

At the end of each brief I like to share a short list of sites, studies, reports, and other interesting gems I came across while researching the piece. Enjoy!

Coalition to Modify NOTA — FAQ Page: A comprehensive FAQ page explaining the details of the proposed End Kidney Deaths Act, financial incentives for kidney donors, and the potential impact on the transplant landscape.

Opinion: Let People Sell Their Kidneys. It Will Save Lives. (NYT) A thought-provoking opinion piece arguing for the need to financially incentivize kidney donations, highlighting the potential benefits for both donors and patients.

Would you donate a kidney for $50,000? (Vox) This is a recent and really well-written, in-depth article that breaks down the ethical and logistical challenges of paying for kidney donations, providing a broad overview of the organ donation landscape. And a special shout out to Dylan Matthews, not only for writing a great piece and inspiring the title, but for sharing his own experience as an altruistic kidney donor on Vox back in 2017.

Saving Lives While Saving Money. (Cato Institute) A report by the Cato Institute’s Ike Brannon (Senior Fellow and Senator John McCain’s former Chief Economist) that explores how financial incentives for organ donation could save both lives and billions in healthcare costs. This piece also has an excellent list of suggested readings here.

How to Stop Losing 17,500 Kidneys. (Statecraft) I’ve shared this one before, and I’ll probably share it again anytime we talk about organ supply. This interview is from one of my personal favorite Substacks, and you should give it a read, too.

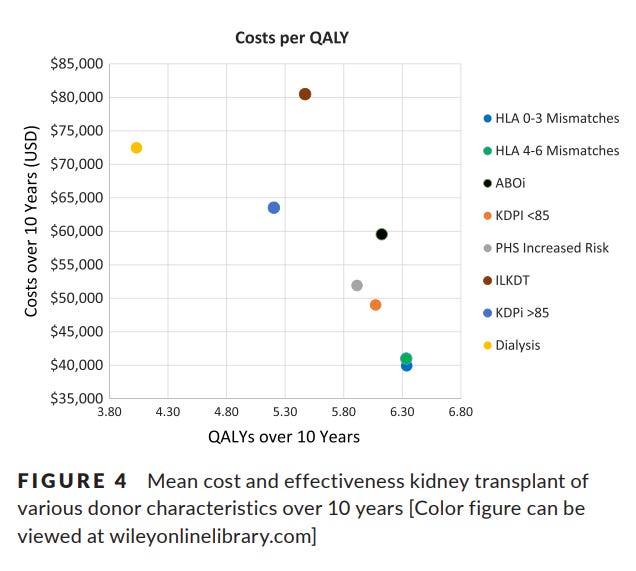

An economic assessment of contemporary kidney transplant practice. (AJT) We cited this one several times in this piece. The first time I saw it was at the ATC meeting in Philadelphia earlier this year. Dr. Axelrod and colleagues shared findings from it during a talk on value-based transplant care. I learn something new every time I read it. Sharing a table below to call your attention to the comparison of cost per QALY over 10 years for each treatment modality (dialysis vs. different types of transplant).

Want to support Signals?

Organ Donation Statistics — organdonor.gov

Saving Lives While Saving Money — CATO Institute

FAQs: How are the estimated financial savings calculated? — modifyNOTA.org

Can You Sell Organs in the United States? — DonorAlliance.org

Axelrod DA, Schnitzler MA, Xiao H, et al. An economic assessment of contemporary kidney transplant practice. Am J Transplant. 2018;18:1168–1176. https://doi.org/10.1111/ajt.14702

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

Very interesting! It makes sense when you look at it in theory and on "paper". It is a win for patients, CMS and taxpayers. If this is approved, I wonder who will be the first and will donors rather have "cash in hand" verus a tax credit over 5 years?

I like Kim's thinking. For a random "altruistic" donation it would need to be cash. Also, given the cost savings, $50k is a little light....