Kidney Capital: Who, When & What Gets Funded In Kidney Care, Part 2

More data from 11 of the most active investors from idea to IPO

Welcome back to Kidney Capital, where great ideas, research, products and teams get funded to build the future of kidney care across the globe.

We continue our exploration of the expanding Kidneyverse with a closer look at why, how, and when these ideas get funded— and who is backing them.

If you need a refresher, Part 1 focused on three Signals including CVS Health’s recent investments in care delivery, Baxter’s buying spree and uncertain future, and Y Combinator’s accelerating healthcare and bio bets.

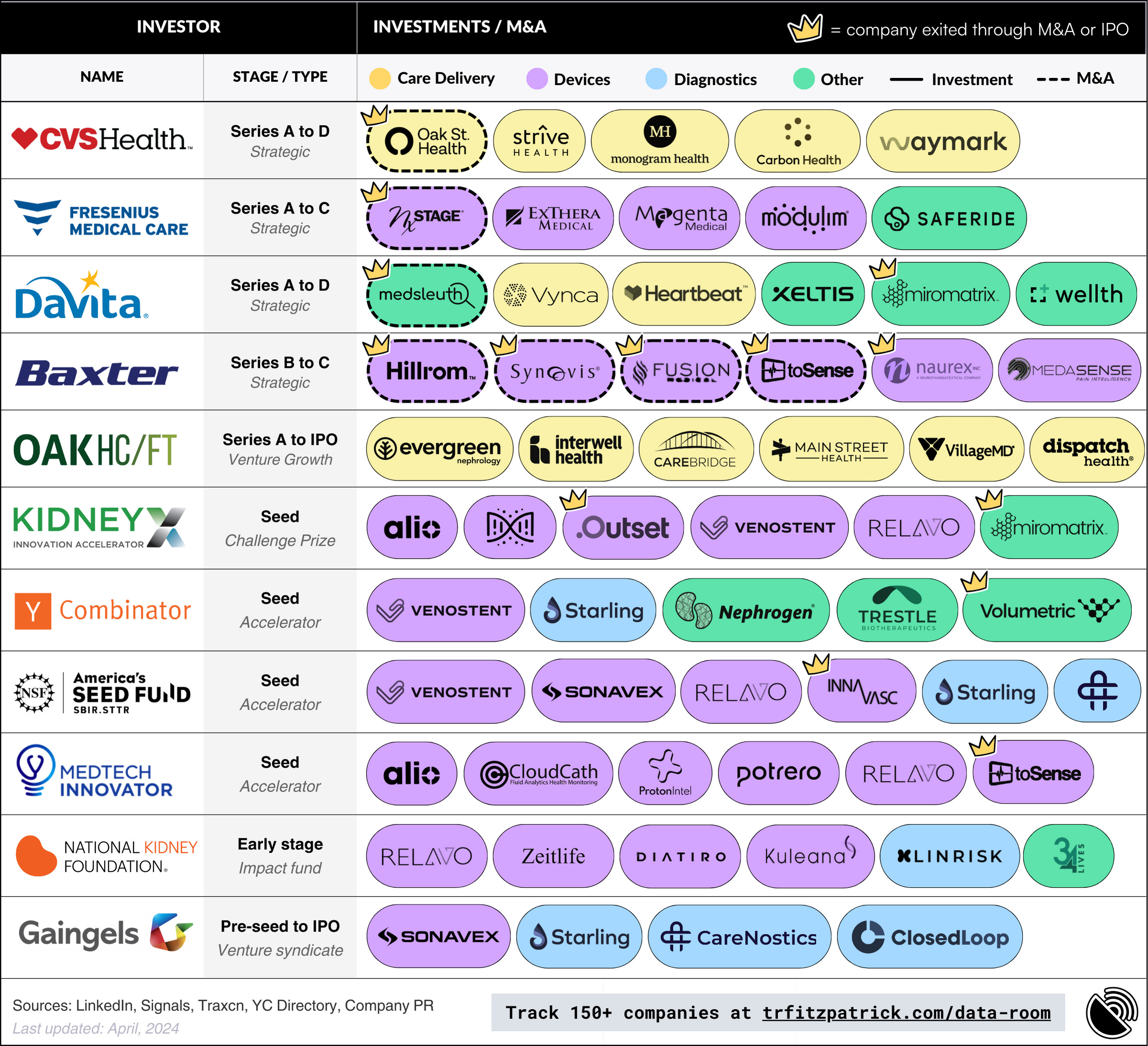

What's in this table:

Who & When: The left-most columns in this table contain 11 of the most active investors in kidney care across the company lifecycle. This group broadly represents four investor types from idea to IPO: (a) accelerators; (b) early stage venture capital; (c) growth equity; and (d) strategic capital.1

What: There are 4 segments (colors) highlighted in this table: Care delivery (yellow), devices (purple), diagnostics (blue), and other (green). For what it’s worth, I track 9 segments across the Kidneyverse.2

Why: Investments happen because founders and investors share a unique point of view about what the future looks like. It’s as much about timing (why now?) as it is about fit (why you?). First, I’ve separated investments (solid border lines) from mergers & acquisitions (dotted lines). Second, I’ve included a crown (“👑”) for companies with an exit, either through M&A or IPO.3

Signals

CVS wants to deliver care… everywhere (Part 1)

Baxter is about to make its biggest bet ever (Part 1)

YC is picking up the pace on its bio x health bets (Part 1)

Why Oak HC/FT is fueling the future of care delivery (Part 3)

IPO Cometh?: will the 2024 IPO window impact kidney care? (Part 3)

A Tale of Two LDOs: comparing dialysis investments (Part 3)

Public dollars at work: how KidneyX and NSF fuel America’s bets on a (not too?) distant future

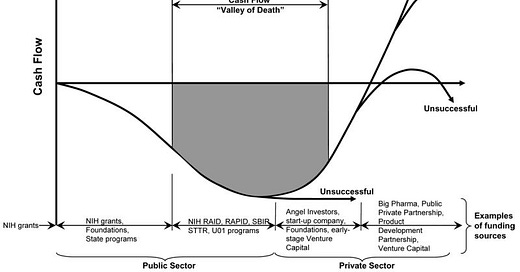

Most people are surprised to learn the government is often the first money into a fledgling company in health and medtech— that is, before other forms of outside private capital. I certainly was.

When you look at the wide spectrum of capital you can get for your business, all the way to one side is venture — the most expensive form of capital reserved for the fastest-growing companies on the planet. By definition, it’s not for everyone — and certainly not out the gates. At the opposite end of that spectrum you have non-dilutive capital, like grants and funds made available through public-private partnerships.

If venture is about picking winners and putting it all on red, non-dilutive funding is about inviting potential winners to the game. Maybe gauntlet is a better word. There’s a reason Squid Games was well-received across science and tech.

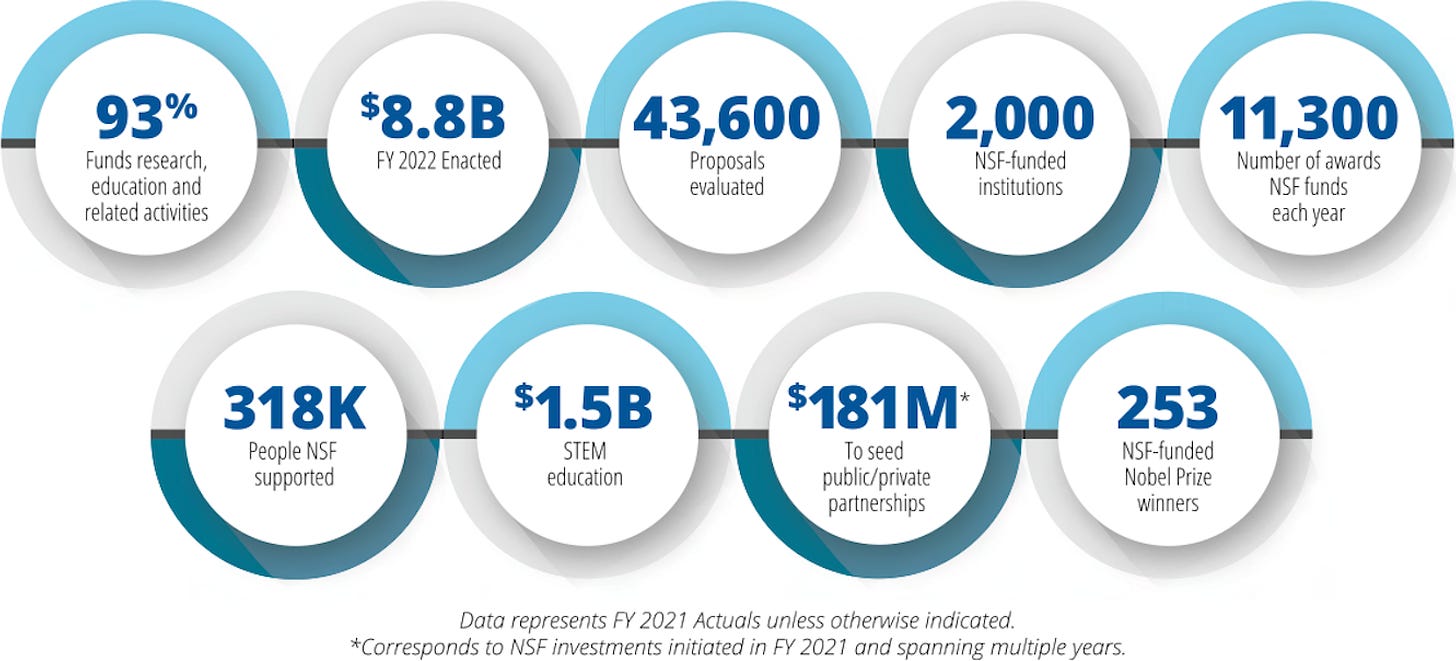

America’s Seed Fund

America’s Seed Fund is powered by the National Science Foundation (NSF), which invests up to $2 million to create new products, services, and other scalable solutions based on fundamental science or engineering.

Each year, NSF funds around 400 companies across nearly all technology areas and market sectors (with the exception of clinical trials and schedule I controlled substances). From 2016 to 2022, NSF-funded startups and small businesses saw around 300 exits and more than $20 billion in private investments.4

KidneyX

KidneyX is a public-private partnership between the US Department of Health and Human Services (HHS) and the American Society of Nephrology (ASN) to accelerate innovation in the prevention, diagnosis, and treatment of kidney diseases. Using a challenge prize format, KidneyX has announced nearly 80 winners across 6 competitions to date, including Artificial Kidney, COVID-19, Redesign Dialysis, and Patient Innovator prizes. Their current Phase 2 Artificial Kidney prize amount is $9.2 million.5

Together, NSF and KidneyX are two small-yet-mighty pieces of the funding puzzle for startups across the company lifecycle. They are vitally important in bringing more ideas and big bets to the table, but they alone will not suffice when it comes to the messy middle of milestones and funding. More on that later.

Notable bets

Venostent was awarded its eventual $1.3 million Phase 2 NSF grant in 2019 to further develop an external stent to improve the quality and length of life for dialysis patients. They then went on to join Y Combinator’s S20 batch and raised their $16 million Series A last July along with receiving IDE approval from FDA.

Outset Medical was also one of 15 winners of the COVID-19 challenge for its cloud-based remote monitoring of the Tablo Hemodialysis System that enabled clinicians to track critical treatment parameters in real time during the COVID-19 pandemic. The company went public in the middle of the pandemic on September 15, 2020.

Qidni Labs won Phase 1 of the Redesign Dialysis challenge in 2019 for its automatic air removal system that can be used safely in a wearable renal therapy device with minimal user intervention. As of last April, the team was recruiting patients for its pilot clinical trials of the Qidni device.

Alio won KidneyX’s COVID-19 challenge, with its end-to-end remote monitoring platform that enables proactive, noninvasive monitoring of hemodialysis patients. Alio has announced a number of new partnerships in recent months, including with Lifeline, Carium, and an expanded presence in the Gulf Cooperation Council (GCC).

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)