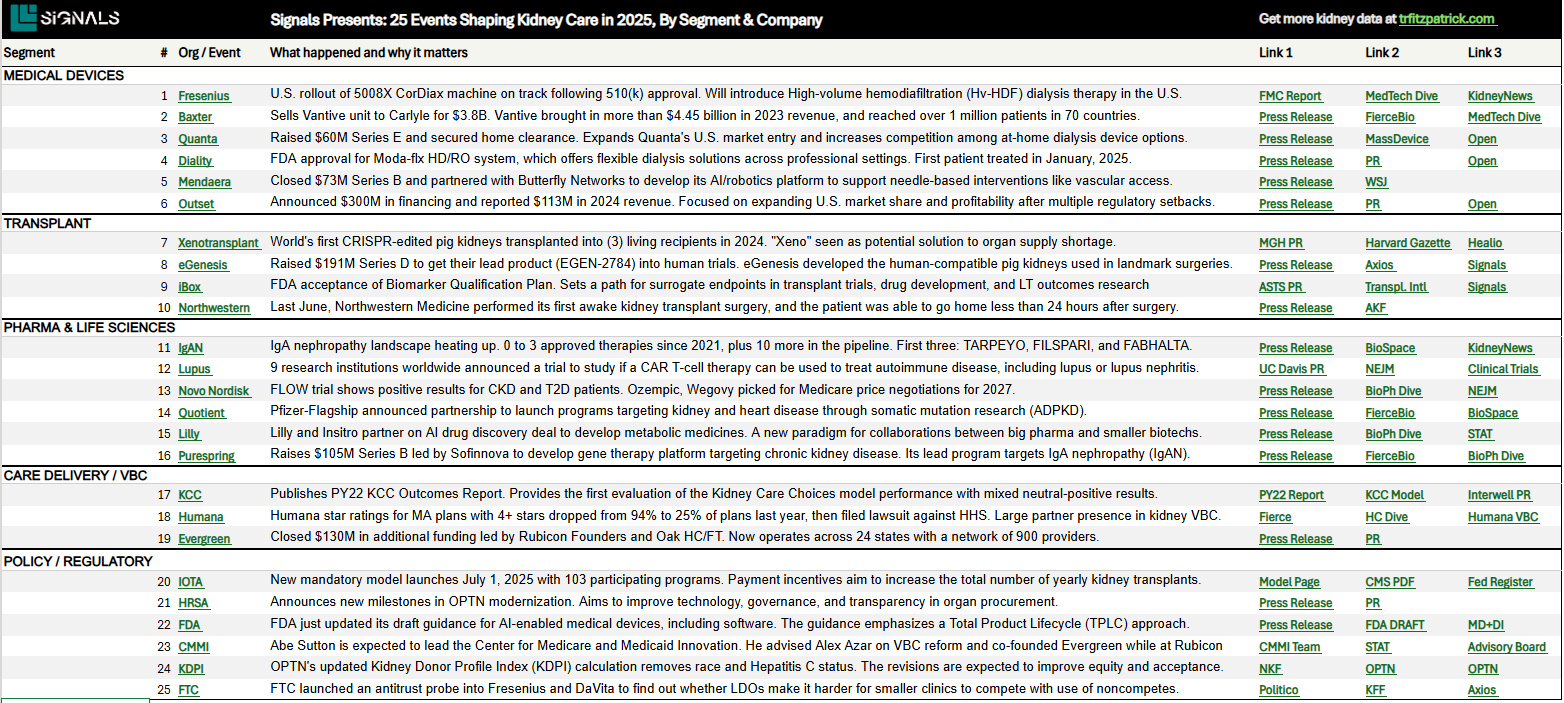

Signals Brief: DaVita Earnings in Q4 2024

Earnings, Cost Pressures, and the Road Ahead: IKC Expansion, Helene’s Impact, Year-over-year Comps, and the Oral Drug Reimbursement Shift

Summary

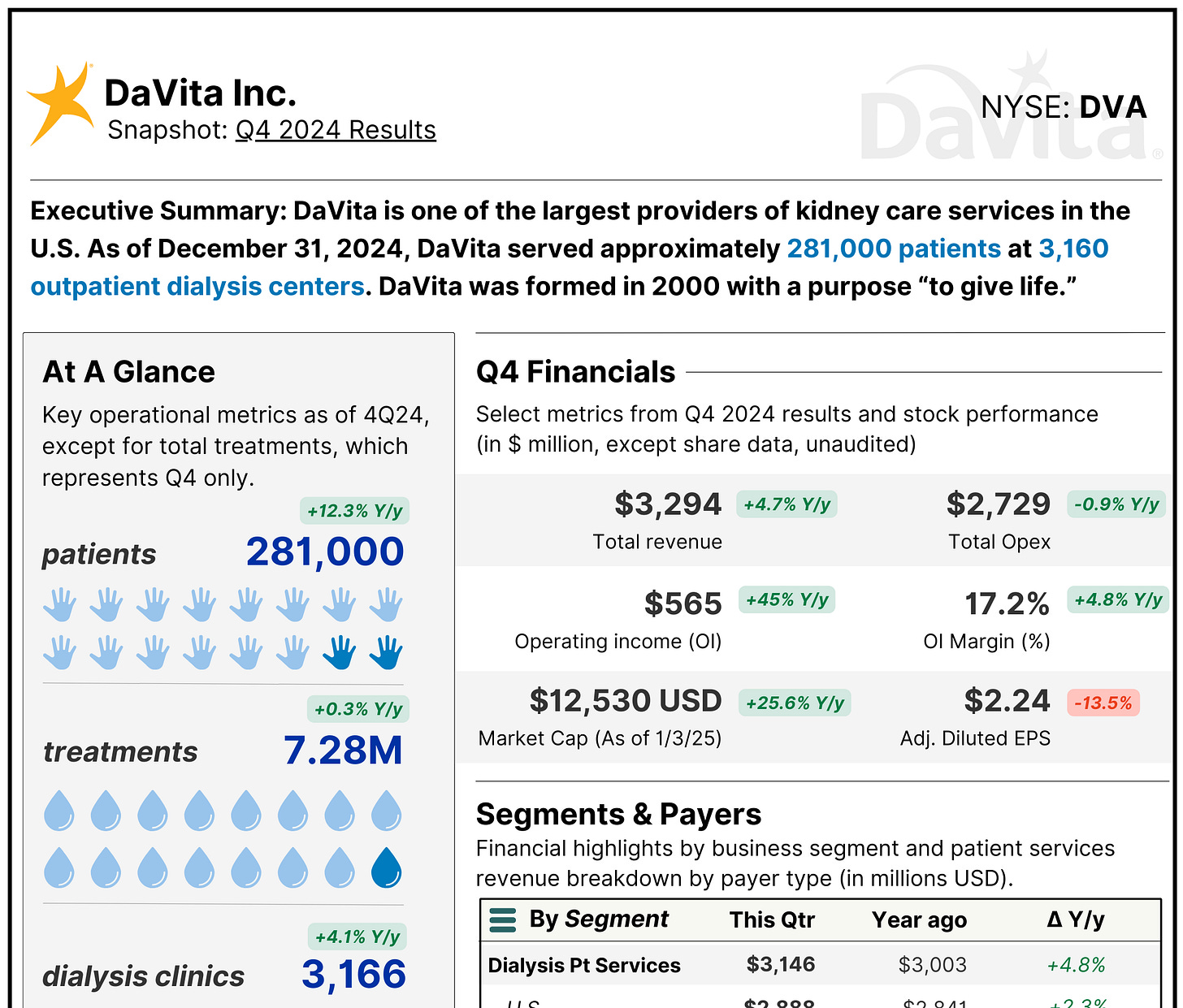

DaVita reported solid financial performance in Q4 2024, with $3.295 billion in revenue (+4.7% YoY) and adjusted EPS of $2.24 (+12.3% YoY). Operating income grew 45% YoY to $565 million, supported by a mix of revenue cycle improvements, reimbursement rate adjustments, and commercial payer mix trends. The company also provided 2025 guidance, projecting flat treatment volumes, 5% revenue per treatment growth, and 6-7% cost per treatment growth. As you can see in the charts below, shares have pulled back from recent highs following the earnings report but remain well above long-term levels, trading near 5-year and all-time highs.

Last 30 Days (-18.7%)

Last 5 Years (+83.8%)

Key Takeaways

Treatment Volumes Expected to Remain Flat in 2025 – Guidance assumes no significant growth in treatment volumes, with impacts from fewer treatment days (leap year adjustment) and PD supply disruptions from Hurricane Helene that slowed admissions in late 2024. Main drivers of treatment volume expectations are treatment days, missed treatments, and elevated mortality rates in comparison to pre-pandemic levels.1

Oral Drug Reimbursement Expands – DaVita expects 5% revenue per treatment growth, with 40% of that tied to the inclusion of oral phosphate binders in the dialysis bundle. Management noted that adherence rates and the mix between branded vs. generic drugs remain variables to monitor as we move past the initial 90-day prescription window. The remainder of the expected operating income (OI) growth is primarily driven by rate increases, collections, and mix improvement.

Cost Pressures Continue – 2025 cost per treatment is expected to rise 6-7%, with labor and drug costs as the primary drivers. This will be a key area to watch for margin impact.

IKC: Small, Growing, & Consistent – IKC remains a growing but unprofitable segment. DaVita’s Integrated Kidney Care (IKC) business reported a $35M adjusted operating loss in 2024, with revenue flat at $508M. While IKC patient volume has grown to around 82,000 as of 2024, it still represents a small portion of DaVita’s total business (~4% of revenue and ~29% of patient volume). The company continues to invest in scaling its VBC models and reaching patients earlier in the disease process.2

Stock and Market Cap Trends – After a strong run-up ahead of earnings, DaVita’s stock has pulled back but remains near all-time highs. The company’s market cap nearly tested $15B prior to the earnings call, reflecting long-term investor confidence, even as near-term challenges like cost pressures and volume trends are being reassessed. As of this writing it sits closer to $11.5B.

Background

DaVita operates 3,166 clinics serving 281,000 patients, making it one of the largest kidney care providers in the U.S. The company’s financials are closely tied to payer mix trends, with Medicare, Medicaid, and commercial plans representing key revenue sources. While commercial revenue has increased slightly this year, it accounts for about one-third of DaVita’s revenue.

The company continues investing in Integrated Kidney Care (IKC), a growing (though not-yet-profitable) segment focused on value-based care models.

What to Watch in 2025

PD Recovery & Volume Trends – Can DaVita offset the Q4 PD admissions impact from supply constraints? They estimate a loss of 350 patients due to these impacts from Hurricane Helene.3 We’ve covered the promise and challenges of PD growth recently—see our deep dive on home dialysis trends from the latest USRDS annual data report here.

Oral Drug Revenue Impact – How will adherence and payer response shape the financial impact of new oral drug reimbursement? The inclusion of oral phosphate binders in the dialysis bundle is significant, but adherence and cost control will determine its financial impact.4 We recently wrote about patient access and open questions about whether the increased bundle payment is “enough” to cover costs. Speaking of which…

Managing Cost Growth – Labor and drug costs are expected to increase—how will DaVita respond? We have an exciting new multi-part series coming your way next month that digs a bit deeper into cross-industry employment models, so we’ll have more for you to unpack on that front soon.

Market Sentiment & Stock Performance – With shares still trading near historical highs, how will investors weigh cost pressures against revenue growth and margin performance? How will payer mix, GLP-1s, home dialysis, and continued advances in organ transplantation impact the dialysis business? We track every one of these trends right here on Signals, so stay tuned.

Downloads

Below you’ll find visuals, tables, and links to download our one-page summary with key metrics from the latest quarter, plus year-over-year comps for 2022-2025E.

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)