What Kidney Week tells us about 2025

Drugs and devices take center stage, while VBC takes a back seat

Kidney Week has come and gone, but the tenor of the event is still fresh in my mind—days packed with sessions, networking, and one-on-one conversations that continue to reverberate in my mind. It was a week of peaks: the close proximity to some of the brightest people I know; the endless expanse of posters and life-saving products; and the chance for spontaneous connection, candor, and insight. Besides, it’s not every day 12,000 kidney professionals descend on a single zip code to talk nephrons. Through the many meetups, coffees, sidewalk chats and a few too many tacos, I think the fog is finally starting to clear on what’s next. As I reflect on the event, what stands out is less so about new technologies, devices, or drugs on the market. Instead, it’s about what was noticeably absent—and what that absence reveals about our current gaps in kidney care.

When we think about the future of kidney care, I think most of us would agree one of the driving forces at work is the ongoing transition to value-based care (VBC). CMMI has set a goal of having 100% of Medicare beneficiaries in a value-based care relationship by 2030. Within that context, the Kidney Care Choices (KCC) model is leading the charge in our world— and it has the potential to prove that it can play a key role in that transition.

But as I walked through the halls of Kidney Week 2024, it was impossible not to notice the conspicuous absence of value-based care in the conversation. The elephant in the room was… barely in the room at all. There were a few booths of course, but the contrast between this and last year’s biggest stage presence was stark. A quick glance up at the rafters filled with towering company logos showed an exhibit hall dominated by pharma, device manufacturers, and biotech firms. In other words, the organizations looking to slow, stop, or prevent kidney disease at the front end; and, those hoping to completely transform the ways and places we deliver treatments for kidney failure.

If this year’s floor plan says anything about what’s next, perhaps it’s that the status quo in kidney care has never been more capable of change than it is today.

Of course, innovation alone is not sufficient. There’s a reason why the Signals tagline also includes ‘ideas’ and ‘investments.’ I expected that VBC would be at the forefront of the conversation this year, especially in light of the KCC Model’s first-year outcomes report. And yet, the discussion around performance metrics, patient outcomes, and incentives for transplant improvements—central to the KCC model—was notably absent. The CMMI discussion that was held in the exhibit hall was small, noisy, and intimate—less than 20 people. The questions that were asked seemed focused on operational details like ‘optimal start’ definitions and narrowing transplant incentives—questions in my mind that would seem critical to how the rest of the people in the room might approach R&D and commercialization for example.

If I were building a Class II-III medical device or delivering a new therapeutic for a population of people with early stage kidney disease, I’m going to have questions for the people designing care models built around risk and shared savings that would ultimately determine if my product gets used at all, let alone adopted into care protocols at scale. Granted, these conversations are happening elsewhere— I’ve joined my fair share of them. Let’s just say the vast majority of net new drugs and devices seem to have big, unanswered questions when it comes to engaging the very people who will ultimately use, prescribe, or pay for their products.

Why is that? Perhaps we’re in a moment where the industry is more focused on immediate breakthroughs in drugs and devices, rather than the longer-term shift toward a more sustainable, outcomes-based system. Or maybe, value-based care is still viewed as a distant challenge, not yet on the radar for most of the stakeholders who will eventually need to operate within it: frontline providers and those developing new devices and therapies. Either way, outside the recent KCC report, the conversation surrounding value-based care seems stalled, and that reset (reckoning?) might be one of the more important forces shaping the next 12 months in the Kidneyverse as providers and practices decide when to get involved, and with which VBC partners.

In stark contrast to the muted presence of VBC discussions, drugs, devices, and diagnostics took center stage at Kidney Week 2024. If you follow my weekly updates, you won’t be surprised to hear drugs and devices are in focus these days. From new therapeutics to dialysis machines, the focus was squarely on how these advances will change the way we approach kidney care. But the real question is: how will these innovations fit into our current system, or not? Beyond the necessary approvals and clinical data, what will prove the deciding factor in how these markets take shape, expand, or disappear over the next decade or longer? But before we get too far ahead of ourselves, here are a few observations I came up with and believe will shape the next 12 months in kidney care.

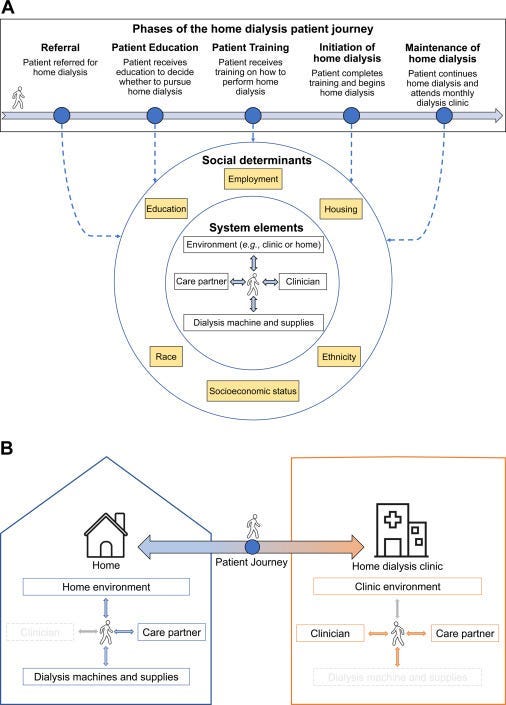

1. More home dialysis devices are on the way. Companies like Outset, Quanta, Diality, Mozarc, Exorenal, NextKidney, Physidia and Vivance (formerly AWAK) are leading the charge with dialysis devices designed to make treatments more accessible and less burdensome for patients. Most (if not all) of these companies are thinking about supporting patients at home. By making home treatments more flexible and easier to manage, the hope is they will enable more patients to receive individualized care in the comfort of their own homes. Still, we will be paying attention to the many system-, provider-, and patient-level barriers that remain. Though home dialysis use grew by 70% between 2012 and 2022, only 14.5% of U.S. dialysis patients receive treatment at home, according to the latest USRDS Annual Report.12

Discussion: What’s holding us back? Despite more devices entering the market, one machine is still used by over 90% of home hemodialysis patients. This highlights a key challenge: is it the devices, or are other barriers—like reimbursement, infrastructure, or patient education—holding back wider adoption?

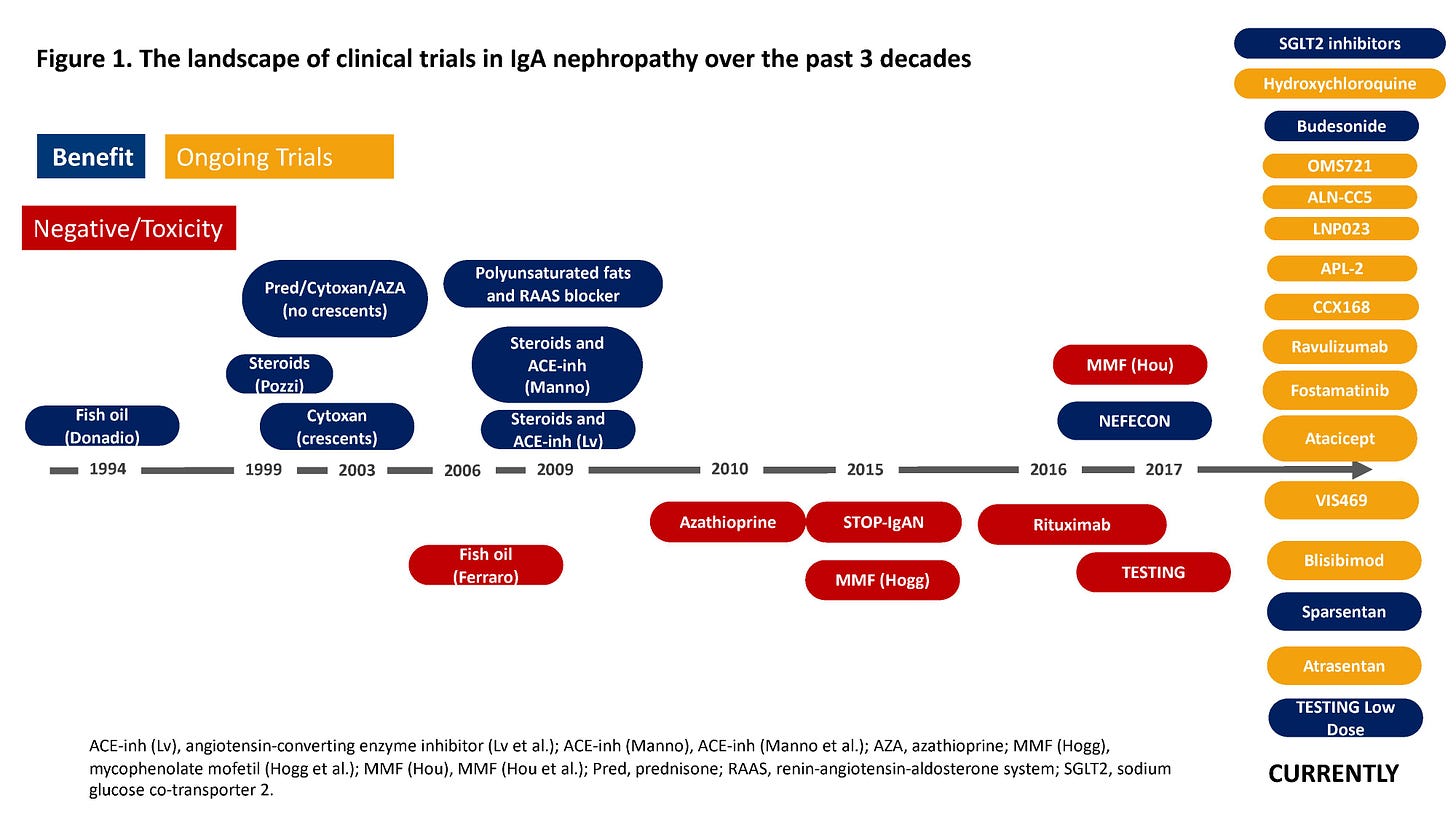

2. The momentum in rare kidney diseases is likely to continue. The focus on rare kidney diseases such as IgA Nephropathy (IgAN) and FSGS continues to gain momentum, thanks in part to companies like Vertex, Biogen, Alexion and Sanofi to name a few. Across medicine, pharma companies are taking a closer look at the 7,000 rare diseases affecting more than 30 million people in the United States alone. Many rare conditions are life threatening and most do not have treatments. Thanks in large part to recent passing of the Orphan Drug Act, 51% of novel drugs approved by the FDA in 2023 received orphan designation. It’s an encouraging sign, especially given the parallel advances in areas like genetic testing and artificial intelligence. The momentum around rare diseases is real. Just look at the 30-year history of IgAN trials below, which has changed considerably even in the 2 years since it was published. Today, there are three approved IgAN treatments on the market. 3

Discussion: The rising interest in rare kidney diseases is a welcome shift, but the big question remains: Will these therapies be affordable and accessible enough to reach the patient populations who need them most? And will industry players and policymakers prioritize these treatments as part of the larger kidney care landscape?

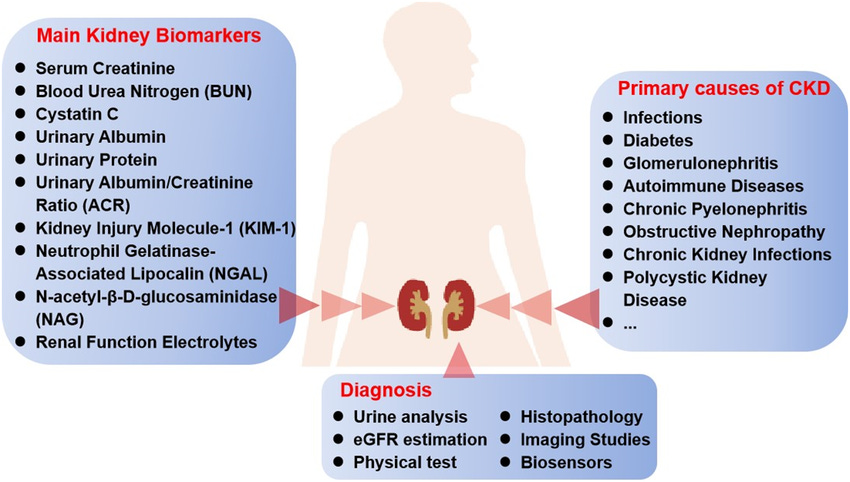

3. Diagnostics and biomarkers could should play a bigger role in kidney care.

While the biotech boom continues to make headlines, another growing area of focus is the potential of diagnostics and biomarkers. Companies like Reliant Glycosciences (a UAB spinout), Healthy.io, and PrognostX are developing new tools to improve early detection and disease management. In fact, new diagnostic technologies like home urine tests already enable us to reach at-risk patients to monitor their kidney function from home. These tests are increasingly seen as essential to slow progression and reduce the number of people experiencing kidney faliure. Given that 90% of CKD cases go undiagnosed until the disease is in its advanced stages, the urgency of bringing new biomarkers and diagnostics to the forefront is clear. If integrated properly into the care model— and with sufficient support from policymakers, agencies, and care protocols— biomarkers could reduce this interstellar gap between prevention, progression and practice.4

Discussion: Will these technologies get the tailwinds they need in 2025? Will it make a difference at scale with provider and patient behavior driving their use? Can we overcome the healthcare system's infrastructure issues to make these tests a standard part of routine kidney care? If so, what will it take, and who will need to be onboard?

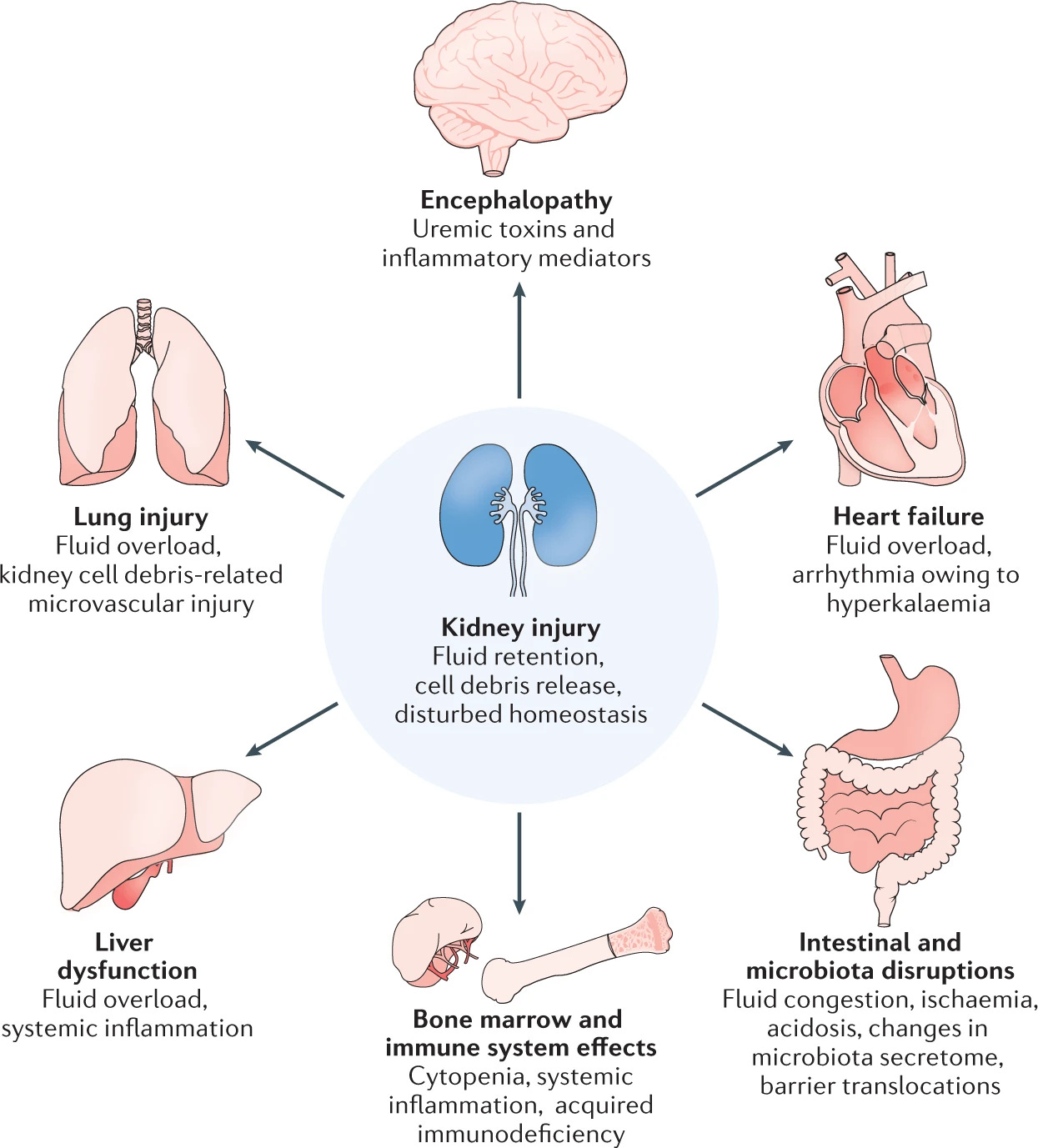

4. Acute Kidney Injury (AKI) is a bigger opportunity than people realize. Acute Kidney Injury (AKI) remains one of the most under-measured and under-discussed areas of kidney care, but that might be changing. Two examples from Kidney Week include BioPorto and SeaStar who are working on solutions to help us detect and treat AKI more effectively. BioPorto recently added the first FDA-cleared damage biomarker for pediatric acute kidney injury (AKI) risk assessment. SeaStar recently earned its breakthrough designation from FDA for its cell-directed Selective Cytopheretic Device (SCD) to treat chronic systemic inflammation in ESRD patients (see video below).

The recent CMS decision to cover home dialysis for people with AKI reflects a broader recognition of AKI's impact on long-term kidney health. Long-term consequences of AKI include chronic kidney disease and cardiovascular morbidity. Thus, prevention and early detection of AKI are essential. . But even with these advancements, the treatment and monitoring of AKI remain fragmented, often occurring in silos. With new AKI monitoring tools and early treatment protocols in place, we could prevent a large percentage of these patients from progressing to kidney failure.5

Discussion: Will the healthcare system prioritize this critical step, or will it continue to focus on end-stage renal disease and dialysis?

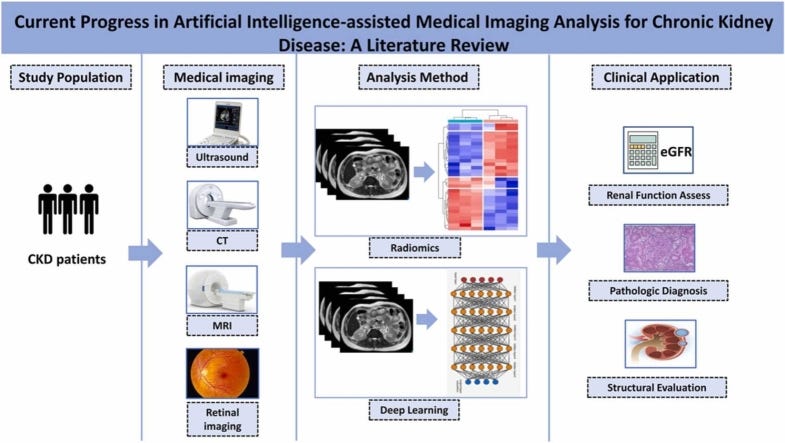

5. Artificial intelligence is becoming more integrated into kidney care.

Artificial Intelligence (AI) and machine learning (ML) technologies are increasingly being applied to kidney care, from improving diagnostics to optimizing treatment plans. Companies like DeLorean, AvoMD and Klinrisk are showing how these technologies can empower providers and care teams to take better control of individual care plans. Radiology give us a healthy dose of inspiration, where research shows AI has the potential to reduce diagnostic time by as much as 30% by quickly analyzing large datasets of medical images and patient information. DeLorean’s recent white paper describes capabilities of its Medical AI solution that was piloted in seventeen (17) Innovative Renal Care (IRC) dialysis centers over a 3-month period.

These AI-driven tools help clinicians make more informed decisions by analyzing large sets of data and identifying patterns that humans might miss. Further upstream, especially in busy settings (i.e. primary care) and complex diseases (i.e. CKD), it might also help us identify undetected and undiagnosed patients earlier. That’s what companies like Klinrisk and Carenostics bring to the table. The widespread adoption of AI in kidney care will take time, and it will depend on its integration into existing care workflows, payment models, and the proverbial crossing of the chasm. As we continue to refine AI algorithms for kidney disease, the challenge will be ensuring that these systems are accurate, reliable, equitable, and accessible.6

Discussion: Will AI lead to better outcomes, more work, or both? Will it take a backseat to more interdisciplinary, team-based approaches in kidney care? What use cases do you find most promising (and possible) within kidney disease over the next 3 to 5 years?

So, what’s next?

Kidney Week 2024 showcased rapid advancements in kidney care, with significant innovations in drugs, devices, and diagnostics. But the real challenge now is integrating these innovations into a system that prioritizes patient outcomes and equitable access for all. As we look ahead, the conversation must shift from simply introducing new technologies to ensuring they’re supported by a system that delivers more value and focuses on improving long-term health outcomes.

Innovation is essential, but without proper alignment with policy changes and care delivery models, the impact will be limited— and funding will fall short.

Moving forward, the key question is this: How do we create a framework that supports both innovation and provides the infrastructure needed for a sustainable, cost-effective, accessible, patient-centered system of kidney care in the United States?

Stay tuned and keep exploring,

— Tim

Cover image: Axios

A partial 2024 USRDS Annual Data Report is available now with select chapters on CKD, home dialysis, vascular access, mortality, and prescription drug coverage in patients with kidney failure. Access it online: https://usrds-adr.niddk.nih.gov/2024/about-the-new-adr

From Chapter 2: “From 2012 to 2022, the percentage of individuals with incident ESRD performing home dialysis increased from 8.5% to 14.5%, a growth of over 70% in relative terms. Growth was fairly steady, although it slowed briefly during the middle of the decade when PD solution was in short supply and again in 2021 during the COVID-19 pandemic. Home HD is a very small contributor to home dialysis use at dialysis initiation: in 2022, the percentage of individuals with incident ESRD performing home HD was only 0.4%. Therefore, growth in incident home dialysis over this period is largely reflective of the growth in PD.”

Fresenius Medical Care Grows Number of U.S. Patients Using Company’s Home Hemodialysis Machines, Launches NxStage® Versi®HD with GuideMe Software. https://www.freseniusmedicalcare.com/en/news/growing-number-of-us-patients-using-home-hemodialysis-machines-launch-nxstage-versirhd-guideme-software

FDA Approves Many New Drugs in 2023 that Will Benefit Patients and Consumers. https://www.fda.gov/news-events/fda-voices/fda-approves-many-new-drugs-2023-will-benefit-patients-and-consumers

Optimizing Pricing And Access For Rare Disease Drugs — Oliver Wyman Report

Point-of-care biosensors and devices for diagnostics of chronic kidney disease. https://www.researchgate.net/publication/384454961_Point-of-care_biosensors_and_devices_for_diagnostics_of_chronic_kidney_disease

Chronic Kidney Disease: Quality Care Begins with Measurement — National Kidney Foundation

Calendar Year 2025 End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) Final Rule (CMS-1805-F). https://www.cms.gov/newsroom/fact-sheets/calendar-year-2025-end-stage-renal-disease-esrd-prospective-payment-system-pps-final-rule-cms-1805-f

The First FDA-Cleared Biomarker Assay for Pediatric AKI — BioPorto

Exploring the Impact of Artificial Intelligence on Global Health and Enhancing Healthcare in Developing Nations. https://pmc.ncbi.nlm.nih.gov/articles/PMC11010755/

DeLorean AI White Paper: https://deloreanai.com/wp-content/uploads/2024/07/TRANSFORMING-RENAL-CARE-2.pdf

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

Hi Tim. Regarding moving patients to home hemodialysis the question was what is the obstacle(s). Is it the device or something else. In my experience this is a very convoluted question and we need to look back to before the patient had to start RRT.

What kind of care did the patient receive before dialysis? Were they a crasher into dialysis or did they see a nephrologist? If they saw a nephrologist, was there discussion around all the modality options for the patient to make an informed consent? Is the nephrologist comfortable discussing home hemodialysis and does he/she understand how to order a prescription for home hemodialysis? Did the patient get the opportunity to experience more frequent dialysis in a transitional unit when starting dialysis. If they were a crasher, did they immediately go to ICHD or did they begin in a transitional care unit/

There is alway so much focus on the device. This is a big component but patients are smart and resilient and good home training nurses can teach any device to patients. If you remember patients used to go home with "traditional" dialysis machines and portable ROs. Todays devices are not as intimidating as traditional equipment when compared.

Are the training nurses good at "training" and educating patients versus case management. We want the best training nurses completing the patient training versus nurses that are not as good. We want success for the patient during training but also continued success after training.

But what about all the other "stuff" once the machine is mastered? We must be honest with the patient that is choosing home hemodiaysis. It is work! We cannot say " it is easy once you learn the machine". Yes it will be challenging but it will get better the more the patient performs their dialysis and time goes on.

Is the patient comfortable with cannulation? Does the patient understand and know when to call the home nurse for any issues and do they know what issues they should call for? Do they actually call the home nurse when needed or put the call off for fear of having to go to the hospital? What about supplies, lab supplies, drawing blood, giving medications/dosing medications, etc. There are so many components beyond the "device" that sometime all the other "stuff" gets lost.

Another component is caregiver or patient burn out in home hemodialysis. Is the patient getting overwhelmed and do they need a break for a short time? Is the patient overwhelming their caregiver by giving all the duties/responsbilities to them? Caregivers want to care for and help their loved ones, but do they speak up? Respite care should be offered to home hemodialysis patients and their caregivers so there is a break from time to time. This must to be assessed by the healthcare team each month.

Great post, finally got the time to read. There’s probably an interesting story in who’s in the KW exhibit hall over the years, would be a good proxy for where the field has been and is going.

I’d love to hear more about the big, unanswered questions standing between end users and innovations. What are the gaps?

Your ending was spot on. We’re at the point where system changes are imperative to support innovation. You can’t build it and hope systemic change will follow.