VBC Directory: Value-Based Kidney Care Companies, Growth, & Outcomes

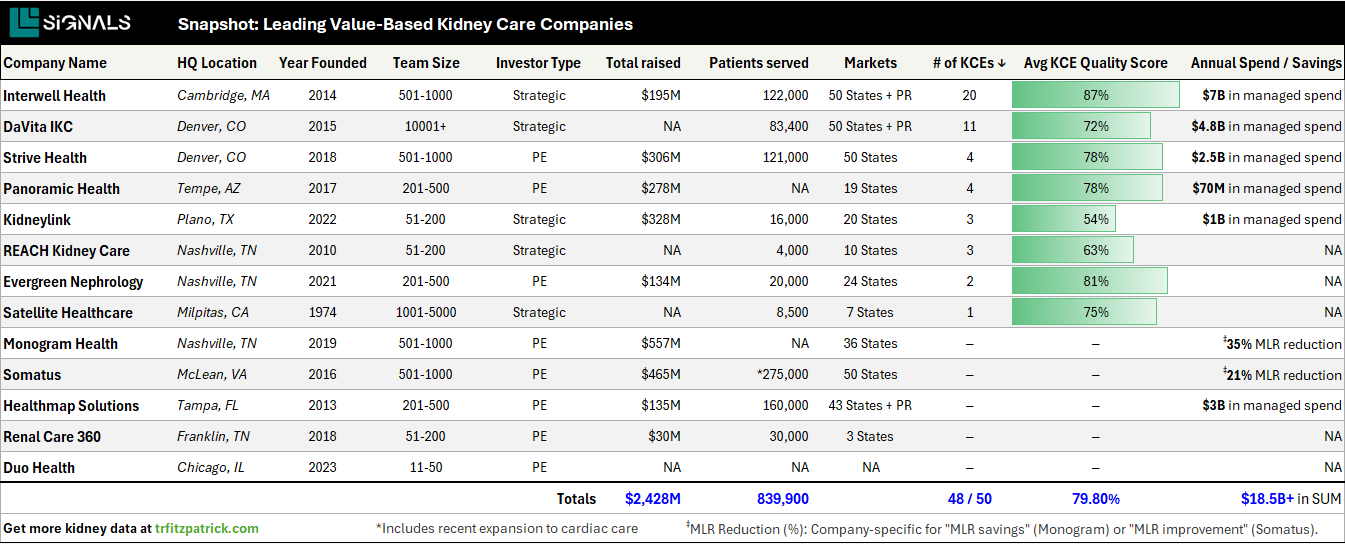

13 companies, 830K+ lives served, $2B+ raised, one mission.

Welcome to the definitive guide to the value-based kidney care landscape, including key metrics on growth, funding, performance, clinical, financial, and operational data by company.

I wrote my first article on value-based kidney care in September, 2023. At the time, we covered 3 VBC companies who then managed around 375,000 lives and around $8 billion in spend. We also discussed the larger trillion-dollar opportunity for value-based care across specialty areas, and why kidney care had room to run.

Since then, we’ve covered the KCC model and its participants, analyzed first year KCC results, asked experts to weigh-in with Q&A on VBC’s future, interviewed KOLs across the space, and looked at the wide spectrum of company capabilities through the lens of national health plan partnerships.

In this updated post you’ll meet 13 companies in the arena who now manage nearly three times as many lives and north of $18 billion in annual medical spend for patients with kidney disease. This reference guide is designed to help you get up to speed quickly, compare key metrics, and navigate the next chapter in nephrology’s ongoing transformation. We’re excited to have you with us.

Let’s get started.

PROVIDER DIRECTORY

Interwell Health

Founded in 2014 and headquartered in Boston, MA, Interwell Health is a leading value-based kidney care provider, serving 122,000 patients across 50 states and Puerto Rico. Since its 3-way merger with Fresenius Health Partners and Cricket Health in 2022, the company has raised $195M in strategic funding positioning it as a key player in this space. Interwell is the largest participant under Medicare's Kidney Care Choices (KCC) program with 24 active KCEs (Kidney Contracting Entities). In the first performance year of the KCC model (PY22), Interwell achieved an average KCE Quality Score of 87% along with 3 perfect scores—the highest and most among its peer group.1

Company 🏢

HQ: Boston, MA

Founded: 2014

Team Size: 501-1,000 employees

Website: interwellhealth.com

Growth & Expansion 📈

Total funding: $195 million

Investor Type: Strategic (FMS 0.00%↑)

Capital partners: 3-Way M&A (FHP, Cricket)

Reach: 122,000 lives across 50 states

Spend: $7 billion under management in 2023

Select Outcomes🏥

150%+ greater optimal start rate vs. national average

85%+ higher home dialysis start rate vs. national average

~20% fewer all-cause hospitalizations vs. national average

600,000+ patients served through VBC to date

KCC Performance (PY22) 📊

Number of KCEs: 20 (24 as of PY24)2

Total Beneficiaries: 51,920

Spending per Beneficiary (CKD): $22,182

Spending per Beneficiary (ESRD): $69,631

Total Expenditure: $2,313,693,265

Home Dialysis True-Up: $885,249

Monies Owed By CMS: $42,192,383

Average Quality Score: 87%

Stock Price Performance (FMS - All Time)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4d588ac1-7fac-4bd4-829d-fc7b4e8f1326_1512x288.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55686857-6b99-45a6-ac0f-09c9f023f2a0_500x500.png)